Page 23 - Watauga FY21 Budget

P. 23

BUDGET MESSAGE FOR FY 2020-2021

General Fund

General Fund Revenues The budget provides funding for continuation of the

majority of current programs and services. The recreation center programs were

evaluated and reductions were made in hours of operation, public use of workout

facilities, and certain events. Revenue projections for FY2020-2021 total $13,383,681,

a decrease of $540,811, or 3.9% from the FY2020-2021 budget. Decreases have been

projected for sales tax, charges for services, franchise fees, and fines and forfeitures,

and interest income.

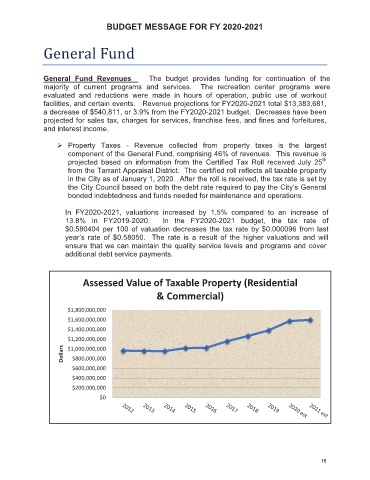

¾ Property Taxes - Revenue collected from property taxes is the largest

component of the General Fund, comprising 46% of revenues. This revenue is

projected based on information from the Certified Tax Roll received July 25 th

from the Tarrant Appraisal District. The certified roll reflects all taxable property

in the City as of January 1, 2020. After the roll is received, the tax rate is set by

the City Council based on both the debt rate required to pay the City’s General

bonded indebtedness and funds needed for maintenance and operations.

In FY2020-2021, valuations increased by 1.5% compared to an increase of

13.8% in FY2019-2020. In the FY2020-2021 budget, the tax rate of

$0.580404 per 100 of valuation decreases the tax rate by $0.000096 from last

year’s rate of $0.58050. The rate is a result of the higher valuations and will

ensure that we can maintain the quality service levels and programs and cover

additional debt service payments.

Assessed Value of Taxable Property (Residential

& Commercial)

$1,800,000,000

$1,600,000,000

$1,400,000,000

$1,200,000,000

Dollars $1,000,000,000

$800,000,000

$600,000,000

$400,000,000

$200,000,000

$0

16