Page 62 - Manfield FY21 Budget

P. 62

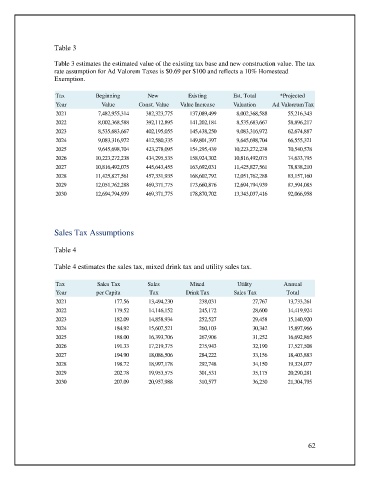

Table 3

Table 3 estimates the estimated value of the existing tax base and new construction value. The tax

rate assumption for Ad Valorem Taxes is $0.69 per $100 and reflects a 10% Homestead

Exemption.

Tax Beginning New Existing Est. Total *Projected

Year Value Const. Value Value Increase Valuation Ad Valoreum Tax

2021 7,482,955,314 382,323,775 137,089,499 8,002,368,588 55,216,343

2022 8,002,368,588 392,112,895 141,202,184 8,535,683,667 58,896,217

2023 8,535,683,667 402,195,055 145,438,250 9,083,316,972 62,674,887

2024 9,083,316,972 412,580,335 149,801,397 9,645,698,704 66,555,321

2025 9,645,698,704 423,278,095 154,295,439 10,223,272,238 70,540,578

2026 10,223,272,238 434,295,535 158,924,302 10,816,492,075 74,633,795

2027 10,816,492,075 445,643,455 163,692,031 11,425,827,561 78,838,210

2028 11,425,827,561 457,331,935 168,602,792 12,051,762,288 83,157,160

2029 12,051,762,288 469,371,775 173,660,876 12,694,794,939 87,594,085

2030 12,694,794,939 469,371,775 178,870,702 13,343,037,416 92,066,958

Sales Tax Assumptions

Table 4

Table 4 estimates the sales tax, mixed drink tax and utility sales tax.

Tax Sales Tax Sales Mixed Utility Annual

Year per Capita Tax Drink Tax Sales Tax Total

2021 177.56 13,494,230 238,031 27,767 13,733,261

2022 179.52 14,146,152 245,172 28,600 14,419,924

2023 182.09 14,858,934 252,527 29,458 15,140,920

2024 184.92 15,607,521 260,103 30,342 15,897,966

2025 188.00 16,393,706 267,906 31,252 16,692,865

2026 191.33 17,219,375 275,943 32,190 17,527,508

2027 194.90 18,086,506 284,222 33,156 18,403,883

2028 198.72 18,997,178 292,748 34,150 19,324,077

2029 202.78 19,953,575 301,531 35,175 20,290,281

2030 207.09 20,957,988 310,577 36,230 21,304,795

62