Page 380 - Keller Budget FY21

P. 380

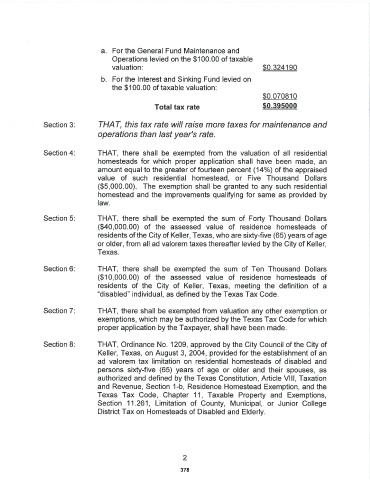

a. For the General Fund Maintenance and

Operations levied on the $ 100. 00 of taxable

valuation: 0. 324190

b. For the Interest and Sinking Fund levied on

the $ 100. 00 of taxable valuation:

0. 070810

0. 395000

Total tax rate

Section 3: THAT, this tax rate will raise more taxes for maintenance and

operations than last year's rate.

Section 4: THAT, there shall be exempted from the valuation of all residential

homesteads for which proper application shall have been made, an

amount equal to the greater of fourteen percent ( 14%) of the appraised

value of such residential homestead, or Five Thousand Dollars

5, 000. 00). The exemption shall be granted to any such residential

homestead and the improvements qualifying for same as provided by

law.

Section 5: THAT, there shall be exempted the sum of Forty Thousand Dollars

40, 000. 00) of the assessed value of residence homesteads of

residents of the City of Keller, Texas, who are sixty-five (65) years of age

or older, from all ad valorem taxes thereafter levied by the City of Keller,

Texas.

Section 6: THAT, there shall be exempted the sum of Ten Thousand Dollars

10, 000. 00) of the assessed value of residence homesteads of

residents of the City of Keller, Texas, meeting the definition of a

disabled" individual, as defined by the Texas Tax Code.

Section 7: THAT, there shall be exempted from valuation any other exemption or

exemptions, which may be authorized by the Texas Tax Code for which

proper application by the Taxpayer, shall have been made.

Section 8: THAT, Ordinance No. 1209, approved by the City Council of the City of

Keller, Texas, on August 3, 2004, provided for the establishment of an

ad valorem tax limitation on residential homesteads of disabled and

persons sixty- five ( 65) years of age or older and their spouses, as

authorized and defined by the Texas Constitution, Article VIII, Taxation

and Revenue, Section 1- b, Residence Homestead Exemption, and the

Texas Tax Code, Chapter 11, Taxable Property and Exemptions,

Section 11. 261, Limitation of County, Municipal, or Junior College

District Tax on Homesteads of Disabled and Elderly.

2

378