Page 48 - Haltom City Budget FY21

P. 48

CITY OF HALTOM CITY ANNUAL BUDGET, FY2021 BUDGET OVERVIEW

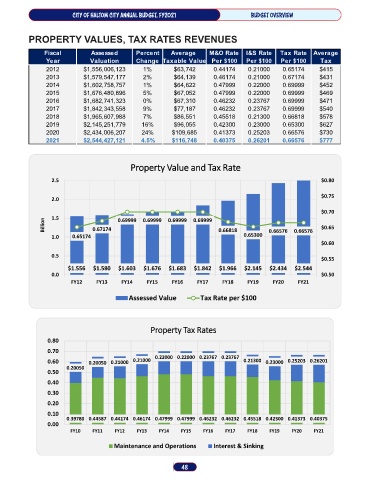

PROPERTY VALUES, TAX RATES REVENUES

Fiscal Assessed Percent Average M&O Rate I&S Rate Tax Rate Average

Year Valuation Change Taxable Value Per $100 Per $100 Per $100 Tax

2012 $1,556,006,123 1% $63,742 0.44174 0.21000 0.65174 $415

2013 $1,579,547,177 2% $64,139 0.46174 0.21000 0.67174 $431

2014 $1,602,758,757 1% $64,622 0.47999 0.22000 0.69999 $452

2015 $1,676,480,896 5% $67,052 0.47999 0.22000 0.69999 $469

2016 $1,682,741,323 0% $67,310 0.46232 0.23767 0.69999 $471

2017 $1,842,343,558 9% $77,187 0.46232 0.23767 0.69999 $540

2018 $1,965,607,988 7% $86,551 0.45518 0.21300 0.66818 $578

2019 $2,145,251,779 16% $96,055 0.42300 0.23000 0.65300 $627

2020 $2,434,006,207 24% $109,685 0.41373 0.25203 0.66576 $730

2021 $2,544,427,121 4.5% $116,748 0.40375 0.26201 0.66576 $777

Property Value and Tax Rate

2.5 $0.80

$0.75

2.0

$0.70

1.5 0.69999 0.69999 0.69999 0.69999

Billion 0.67174 0.66818 0.66576 0.66576 $0.65

1.0 0.65174 0.65300

$0.60

0.5 $0.55

$1.556 $1.580 $1.603 $1.676 $1.683 $1.842 $1.966 $2.145 $2.434 $2.544

0.0 $0.50

FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21

Assessed Value Tax Rate per $100

Property Tax Rates

0.80

0.70

0.22000 0.22000 0.23767 0.23767

0.60 0.20050 0.21000 0.21000 0.21300 0.23000 0.25203 0.26201

0.20050

0.50

0.40

0.30

0.20

0.10 0.39780 0.44587 0.44174 0.46174 0.47999 0.47999 0.46232 0.46232 0.45518 0.42300 0.41373 0.40375

0.00

FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21

Maintenance and Operations Interest & Sinking

48