Page 43 - Haltom City Budget FY21

P. 43

CITY OF HALTOM CITY ANNUAL BUDGET, FY2021 BUDGET OVERVIEW

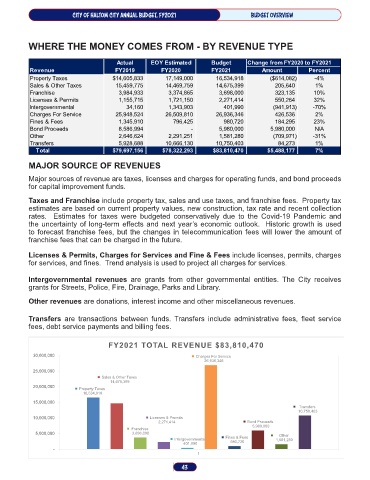

WHERE THE MONEY COMES FROM - BY REVENUE TYPE

Actual EOY Estimated Budget Change from FY2020 to FY2021

Revenue FY2019 FY2020 FY2021 Amount Percent

Property Taxes $14,605,833 17,149,000 16,534,918 ($614,082) -4%

Sales & Other Taxes 15,459,775 14,469,759 14,675,399 205,640 1%

Franchise 3,984,933 3,374,865 3,698,000 323,135 10%

Licenses & Permits 1,155,715 1,721,150 2,271,414 550,264 32%

Intergovernmental 34,160 1,343,903 401,990 (941,913) -70%

Charges For Service 25,948,524 26,509,810 26,936,346 426,536 2%

Fines & Fees 1,345,910 796,425 980,720 184,295 23%

Bond Proceeds 8,586,994 - 5,980,000 5,980,000 N/A

Other 2,646,624 2,291,251 1,581,280 (709,971) -31%

Transfers 5,928,688 10,666,130 10,750,403 84,273 1%

Total $79,697,156 $78,322,293 $83,810,470 $5,488,177 7%

MAJOR SOURCE OF REVENUES

Major sources of revenue are taxes, licenses and charges for operating funds, and bond proceeds

for capital improvement funds.

Taxes and Franchise include property tax, sales and use taxes, and franchise fees. Property tax

estimates are based on current property values, new construction, tax rate and recent collection

rates. Estimates for taxes were budgeted conservatively due to the Covid-19 Pandemic and

the uncertainty of long-term effects and next year’s economic outlook. Historic growth is used

to forecast franchise fees, but the changes in telecommunication fees will lower the amount of

franchise fees that can be charged in the future.

Licenses & Permits, Charges for Services and Fine & Fees include licenses, permits, charges

for services, and fines. Trend analysis is used to project all charges for services.

Intergovernmental revenues are grants from other governmental entities. The City receives

grants for Streets, Police, Fire, Drainage, Parks and Library.

Other revenues are donations, interest income and other miscellaneous revenues.

Transfers are transactions between funds. Transfers include administrative fees, fleet service

fees, debt service payments and billing fees.

FY2021 TOTAL REVENUE $83,810,470

30,000,000 Charges For Service

26,936,346

25,000,000

Sales & Other Taxes

14,675,399

20,000,000

Property Taxes

16,534,918

15,000,000

Transfers

10,750,403

10,000,000 Licenses & Permits

2,271,414 Bond Proceeds

5,980,000

Franchise

5,000,000 3,698,000 Other

Intergovernmental Fines & Fees 1,581,280

401,990 980,720

-

1

43