Page 215 - Colleyville FY21 Budget

P. 215

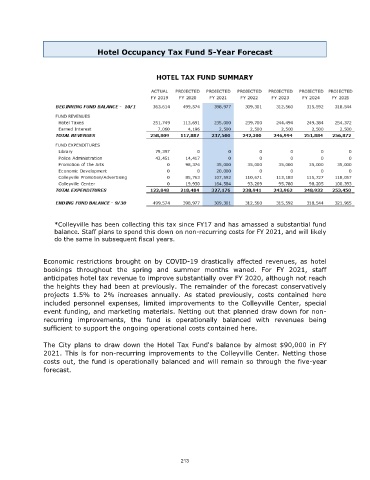

Hotel Occupancy Tax Fund 5-Year Forecast

*Colleyville has been collecting this tax since FY17 and has amassed a substantial fund

balance. Staff plans to spend this down on non-recurring costs for FY 2021, and will likely

do the same in subsequent fiscal years.

Economic restrictions brought on by COVID-19 drastically affected revenues, as hotel

bookings throughout the spring and summer months waned. For FY 2021, staff

anticipates hotel tax revenue to improve substantially over FY 2020, although not reach

the heights they had been at previously. The remainder of the forecast conservatively

projects 1.5% to 2% increases annually. As stated previously, costs contained here

included personnel expenses, limited improvements to the Colleyville Center, special

event funding, and marketing materials. Netting out that planned draw down for non-

recurring improvements, the fund is operationally balanced with revenues being

sufficient to support the ongoing operational costs contained here.

The City plans to draw down the Hotel Tax Fund's balance by almost $90,000 in FY

2021. This is for non-recurring improvements to the Colleyville Center. Netting those

costs out, the fund is operationally balanced and will remain so through the five-year

forecast.

213