Page 129 - Benbrook FY2021

P. 129

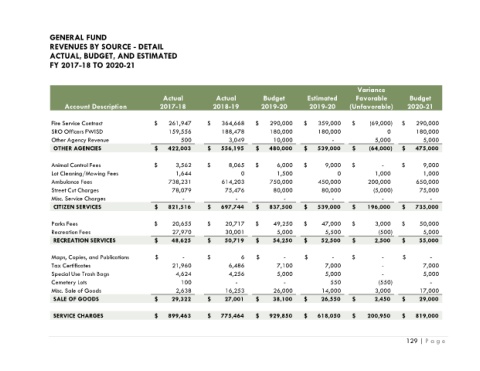

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2017-18 TO 2020-21

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2017-18 2018-19 2019-20 2019-20 (Unfavorable) 2020-21

Fire Service Contract $ 261,947 $ 364,668 $ 290,000 $ 359,000 $ (69,000) $ 290,000

SRO Officers FWISD 159,556 188,478 180,000 180,000 0 180,000

Other Agency Revenue 500 3,049 10,000 - 5,000 5,000

OTHER AGENCIES $ 422,003 $ 556,195 $ 480,000 $ 539,000 $ (64,000) $ 475,000

Animal Control Fees $ 3,562 $ 8,065 $ 6,000 $ 9,000 $ - $ 9,000

Lot Cleaning/Mowing Fees 1,644 0 1,500 0 1,000 1,000

Ambulance Fees 738,231 614,203 750,000 450,000 200,000 650,000

Street Cut Charges 78,079 75,476 80,000 80,000 (5,000) 75,000

Misc. Service Charges - - - - - -

CITIZEN SERVICES $ 821,516 $ 697,744 $ 837,500 $ 539,000 $ 196,000 $ 735,000

Parks Fees $ 20,655 $ 20,717 $ 49,250 $ 47,000 $ 3,000 $ 50,000

Recreation Fees 27,970 30,001 5,000 5,500 (500) 5,000

RECREATION SERVICES $ 48,625 $ 50,719 $ 54,250 $ 52,500 $ 2,500 $ 55,000

Maps, Copies, and Publications $ - $ 6 $ - $ - $ - $ -

Tax Certificates 21,960 6,486 7,100 7,000 - 7,000

Special Use Trash Bags 4,624 4,256 5,000 5,000 - 5,000

Cemetery Lots 100 - - 550 (550) -

Misc. Sale of Goods 2,638 16,253 26,000 14,000 3,000 17,000

SALE OF GOODS $ 29,322 $ 27,001 $ 38,100 $ 26,550 $ 2,450 $ 29,000

SERVICE CHARGES $ 899,463 $ 775,464 $ 929,850 $ 618,050 $ 200,950 $ 819,000

129 | P a g e