Page 133 - Benbrook FY2021

P. 133

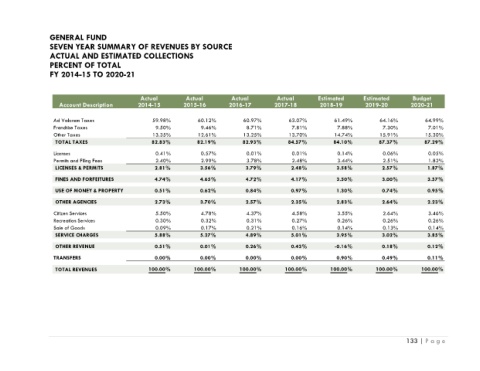

GENERAL FUND

SEVEN YEAR SUMMARY OF REVENUES BY SOURCE

ACTUAL AND ESTIMATED COLLECTIONS

PERCENT OF TOTAL

FY 2014-15 TO 2020-21

Actual Actual Actual Actual Estimated Estimated Budget

Account Description 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21

Ad Valorem Taxes 59.98% 60.12% 60.97% 63.07% 61.49% 64.16% 64.99%

Franchise Taxes 9.50% 9.46% 8.71% 7.81% 7.88% 7.30% 7.01%

Other Taxes 13.35% 12.61% 13.25% 13.70% 14.74% 15.91% 15.30%

TOTAL TAXES 82.83% 82.19% 82.93% 84.57% 84.10% 87.37% 87.29%

Licenses 0.41% 0.57% 0.01% 0.01% 0.14% 0.06% 0.05%

Permits and Filing Fees 2.40% 2.99% 3.78% 2.48% 3.44% 2.51% 1.82%

LICENSES & PERMITS 2.81% 3.56% 3.79% 2.48% 3.58% 2.57% 1.87%

FINES AND FORFEITURES 4.74% 4.65% 4.72% 4.17% 3.50% 3.00% 3.57%

USE OF MONEY & PROPERTY 0.51% 0.62% 0.84% 0.97% 1.30% 0.74% 0.95%

OTHER AGENCIES 2.73% 3.70% 2.57% 2.35% 2.83% 2.64% 2.23%

Citizen Services 5.50% 4.78% 4.37% 4.58% 3.55% 2.64% 3.46%

Recreation Services 0.30% 0.32% 0.31% 0.27% 0.26% 0.26% 0.26%

Sale of Goods 0.09% 0.17% 0.21% 0.16% 0.14% 0.13% 0.14%

SERVICE CHARGES 5.88% 5.27% 4.89% 5.01% 3.95% 3.02% 3.85%

OTHER REVENUE 0.51% 0.01% 0.26% 0.43% -0.16% 0.18% 0.12%

TRANSFERS 0.00% 0.00% 0.00% 0.00% 0.90% 0.49% 0.11%

TOTAL REVENUES 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

133 | P a g e