Page 127 - Benbrook FY2021

P. 127

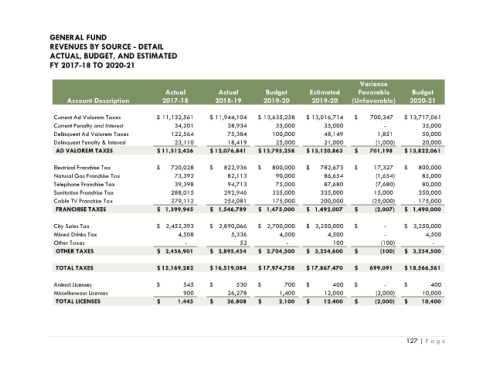

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2017-18 TO 2020-21

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2017-18 2018-19 2019-20 2019-20 (Unfavorable) 2020-21

Current Ad Valorem Taxes $ 11,132,561 $ 11,944,104 $ 13,635,258 $ 13,016,714 $ 700,347 $ 13,717,061

Current Penalty and Interest 34,201 38,934 35,000 35,000 - 35,000

Delinquent Ad Valorem Taxes 122,564 75,384 100,000 48,149 1,851 50,000

Delinquent Penalty & Interest 23,110 18,419 25,000 21,000 (1,000) 20,000

AD VALOREM TAXES $ 11,312,436 $ 12,076,841 $ 13,795,258 $ 13,120,863 $ 701,198 $ 13,822,061

Electrical Franchise Tax $ 720,028 $ 822,936 $ 800,000 $ 782,673 $ 17,327 $ 800,000

Natural Gas Franchise Tax 73,392 82,113 90,000 86,654 (1,654) 85,000

Telephone Franchise Tax 39,398 94,713 75,000 87,680 (7,680) 80,000

Sanitation Franchise Tax 288,015 292,946 335,000 335,000 15,000 350,000

Cable TV Franchise Tax 279,112 254,081 175,000 200,000 (25,000) 175,000

FRANCHISE TAXES $ 1,399,945 $ 1,546,789 $ 1,475,000 $ 1,492,007 $ (2,007) $ 1,490,000

City Sales Tax $ 2,452,393 $ 2,890,066 $ 2,700,000 $ 3,250,000 $ - $ 3,250,000

Mixed Drinks Tax 4,508 5,336 4,500 4,500 - 4,500

Other Taxes - 52 - 100 (100) -

OTHER TAXES $ 2,456,901 $ 2,895,454 $ 2,704,500 $ 3,254,600 $ (100) $ 3,254,500

TOTAL TAXES $ 15,169,282 $ 16,519,084 $ 17,974,758 $ 17,867,470 $ 699,091 $ 18,566,561

Animal Licenses $ 545 $ 530 $ 700 $ 400 $ - $ 400

Miscellaneous Licenses 900 26,278 1,400 12,000 (2,000) 10,000

TOTAL LICENSES $ 1,445 $ 26,808 $ 2,100 $ 12,400 $ (2,000) $ 10,400

127 | P a g e