Page 443 - City of Bedford FY21 Budget

P. 443

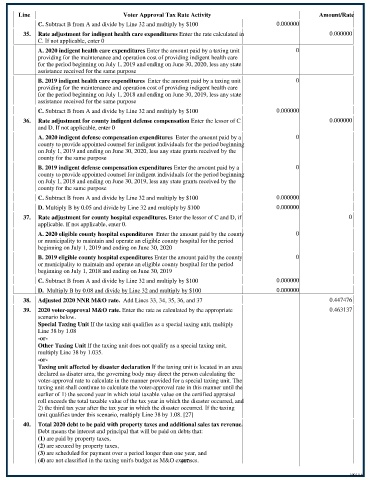

Line Voter Approval Tax Rate Activity Amount/Rate

C. Subtract B from A and divide by Line 32 and multiply by $100 0.000000

35. Rate adjustment for indigent health care expenditures Enter the rate calculated in 0.000000

C. If not applicable, enter 0

A. 2020 indigent health care expenditures Enter the amount paid by a taxing unit 0

providing for the maintenance and operation cost of providing indigent health care

for the period beginning on July 1, 2019 and ending on June 30, 2020, less any state

assistance received for the same purpose

B. 2019 indigent health care expenditures Enter the amount paid by a taxing unit 0

providing for the maintenance and operation cost of providing indigent health care

for the period beginning on July 1, 2018 and ending on June 30, 2019, less any state

assistance received for the same purpose

C. Subtract B from A and divide by Line 32 and multiply by $100 0.000000

36. Rate adjustment for county indigent defense compensation Enter the lessor of C 0.000000

and D. If not applicable, enter 0

A. 2020 indigent defense compensation expenditures Enter the amount paid by a 0

county to provide appointed counsel for indigent individuals for the period beginning

on July 1, 2019 and ending on June 30, 2020, less any state grants received by the

county for the same purpose

B. 2019 indigent defense compensation expenditures Enter the amount paid by a 0

county to provide appointed counsel for indigent individuals for the period beginning

on July 1, 2018 and ending on June 30, 2019, less any state grants received by the

county for the same purpose

C. Subtract B from A and divide by Line 32 and multiply by $100 0.000000

D. Multiply B by 0.05 and divide by Line 32 and multiply by $100 0.000000

37. Rate adjustment for county hospital expenditures. Enter the lessor of C and D, if 0

applicable. If not applicable, enter 0.

A. 2020 eligible county hospital expenditures Enter the amount paid by the county 0

or municipality to maintain and operate an eligible county hospital for the period

beginning on July 1, 2019 and ending on June 30, 2020

B. 2019 eligible county hospital expenditures Enter the amount paid by the county 0

or municipality to maintain and operate an eligible county hospital for the period

beginning on July 1, 2018 and ending on June 30, 2019

C. Subtract B from A and divide by Line 32 and multiply by $100 0.000000

D. Multiply B by 0.08 and divide by Line 32 and multiply by $100 0.000000

38. Adjusted 2020 NNR M&O rate. Add Lines 33, 34, 35, 36, and 37 0.447476

39. 2020 voter-approval M&O rate. Enter the rate as calculated by the appropriate 0.463137

scenario below.

Special Taxing Unit If the taxing unit qualifies as a special taxing unit, multiply

Line 38 by 1.08

-or-

Other Taxing Unit If the taxing unit does not qualify as a special taxing unit,

multiply Line 38 by 1.035.

-or-

Taxing unit affected by disaster declaration If the taxing unit is located in an area

declared as disater area, the governing body may direct the person calculating the

voter-approval rate to calculate in the manner provided for a special taxing unit. The

taxing unit shall continue to calculate the voter-approval rate in this manner until the

earlier of 1) the second year in which total taxable value on the certified appraisal

roll exceeds the total taxable value of the tax year in which the disaster occurred, and

2) the third tax year after the tax year in which the disaster occurred. If the taxing

unit qualifies under this scenario, multiply Line 38 by 1.08. [27]

40. Total 2020 debt to be paid with property taxes and additional sales tax revenue.

Debt means the interest and principal that will be paid on debts that:

(1) are paid by property taxes,

(2) are secured by property taxes,

(3) are scheduled for payment over a period longer than one year, and

407

(4) are not classified in the taxing unit's budget as M&O expenses.

1001.1.6