Page 442 - City of Bedford FY21 Budget

P. 442

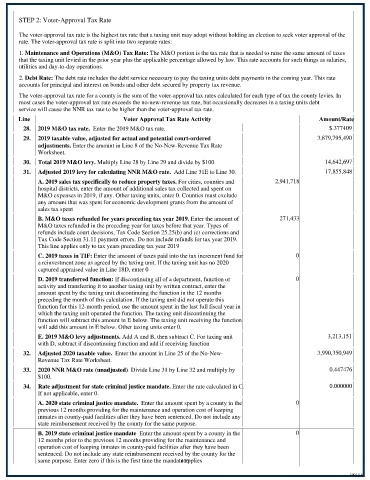

STEP 2: Voter-Approval Tax Rate

The voter-approval tax rate is the highest tax rate that a taxing unit may adopt without holding an election to seek voter approval of the

rate. The voter-approval tax rate is split into two separate rates:

1. Maintenance and Operations (M&O) Tax Rate: The M&O portion is the tax rate that is needed to raise the same amount of taxes

that the taxing unit levied in the prior year plus the applicable percentage allowed by law. This rate accounts for such things as salaries,

utilities and day-to-day operations.

2. Debt Rate: The debt rate includes the debt service necessary to pay the taxing unit s debt payments in the coming year. This rate

accounts for principal and interest on bonds and other debt secured by property tax revenue.

The voter-approval tax rate for a county is the sum of the voter-approval tax rates calculated for each type of tax the county levies. In

most cases the voter-approval tax rate exceeds the no-new-revenue tax rate, but occasionally decreases in a taxing unit s debt

service will cause the NNR tax rate to be higher than the voter-approval tax rate.

Line Voter Approval Tax Rate Activity Amount/Rate

28. 2019 M&O tax rate. Enter the 2019 M&O tax rate. $.377409

29. 2019 taxable value, adjusted for actual and potential court-ordered 3,879,795,490

adjustments. Enter the amount in Line 8 of the No-New-Revenue Tax Rate

Worksheet.

30. Total 2019 M&O levy. Multiply Line 28 by Line 29 and divide by $100 14,642,697

31. Adjusted 2019 levy for calculating NNR M&O rate. Add Line 31E to Line 30. 17,855,848

A. 2019 sales tax specifically to reduce property taxes. For cities, counties and 2,941,718

hospital districts, enter the amount of additional sales tax collected and spent on

M&O expenses in 2019, if any. Other taxing units, enter 0. Counties must exclude

any amount that was spent for economic development grants from the amount of

sales tax spent

B. M&O taxes refunded for years preceding tax year 2019. Enter the amount of 271,433

M&O taxes refunded in the preceding year for taxes before that year. Types of

refunds include court decisions, Tax Code Section 25.25(b) and (c) corrections and

Tax Code Section 31.11 payment errors. Do not include refunds for tax year 2019.

This line applies only to tax years preceding tax year 2019

C. 2019 taxes in TIF: Enter the amount of taxes paid into the tax increment fund for 0

a reinvestment zone as agreed by the taxing unit. If the taxing unit has no 2020

captured appraised value in Line 18D, enter 0

D. 2019 transferred function: If discontinuing all of a department, function or 0

activity and transferring it to another taxing unit by written contract, enter the

amount spent by the taxing unit discontinuing the function in the 12 months

preceding the month of this calculation. If the taxing unit did not operate this

function for this 12-month period, use the amount spent in the last full fiscal year in

which the taxing unit operated the function. The taxing unit discontinuing the

function will subtract this amount in E below. The taxing unit receiving the function

will add this amount in E below. Other taxing units enter 0.

E. 2019 M&O levy adjustments. Add A and B, then subtract C. For taxing unit 3,213,151

with D, subtract if discontinuing function and add if receiving function

32. Adjusted 2020 taxable value. Enter the amount in Line 25 of the No-New- 3,990,350,949

Revenue Tax Rate Worksheet.

33. 2020 NNR M&O rate (unadjusted) Divide Line 31 by Line 32 and multiply by 0.447476

$100.

34. Rate adjustment for state criminal justice mandate. Enter the rate calculated in C. 0.000000

If not applicable, enter 0.

A. 2020 state criminal justice mandate. Enter the amount spent by a county in the 0

previous 12 months providing for the maintenance and operation cost of keeping

inmates in county-paid facilities after they have been sentenced. Do not include any

state reimbursement received by the county for the same purpose.

B. 2019 state criminal justice mandate Enter the amount spent by a county in the 0

12 months prior to the previous 12 months providing for the maintenance and

operation cost of keeping inmates in county-paid facilities after they have been

sentenced. Do not include any state reimbursement received by the county for the

406

same purpose. Enter zero if this is the first time the mandate applies

1001.1.6