Page 440 - City of Bedford FY21 Budget

P. 440

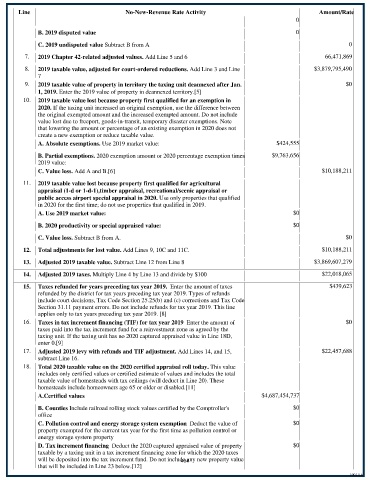

Line No-New-Revenue Rate Activity Amount/Rate

0

B. 2019 disputed value 0

C. 2019 undisputed value Subtract B from A 0

7. 2019 Chapter 42-related adjusted values. Add Line 5 and 6 66,471,869

8. 2019 taxable value, adjusted for court-ordered reductions. Add Line 3 and Line $3,879,795,490

7

9. 2019 taxable value of property in territory the taxing unit deannexed after Jan. $0

1, 2019. Enter the 2019 value of property in deannexed territory.[5]

10. 2019 taxable value lost because property first qualified for an exemption in

2020. If the taxing unit increased an original exemption, use the difference between

the original exempted amount and the increased exempted amount. Do not include

value lost due to freeport, goods-in-transit, temporary disaster exemptions. Note

that lowering the amount or percentage of an existing exemption in 2020 does not

create a new exemption or reduce taxable value.

A. Absolute exemptions. Use 2019 market value: $424,555

B. Partial exemptions. 2020 exemption amount or 2020 percentage exemption times $9,763,656

2019 value:

C. Value loss. Add A and B.[6] $10,188,211

11. 2019 taxable value lost because property first qualified for agricultural

appraisal (1-d or 1-d-1),timber appraisal, recreational/scenic appraisal or

public access airport special appraisal in 2020. Use only properties that qualified

in 2020 for the first time; do not use properties that qualified in 2019.

A. Use 2019 market value: $0

B. 2020 productivity or special appraised value: $0

C. Value loss. Subtract B from A. $0

12. Total adjustments for lost value. Add Lines 9, 10C and 11C. $10,188,211

13. Adjusted 2019 taxable value. Subtract Line 12 from Line 8 $3,869,607,279

14. Adjusted 2019 taxes. Multiply Line 4 by Line 13 and divide by $100 $22,018,065

15. Taxes refunded for years preceding tax year 2019. Enter the amount of taxes $439,623

refunded by the district for tax years preceding tax year 2019. Types of refunds

include court decisions, Tax Code Section 25.25(b) and (c) corrections and Tax Code

Section 31.11 payment errors. Do not include refunds for tax year 2019. This line

applies only to tax years preceding tax year 2019. [8]

16. Taxes in tax increment financing (TIF) for tax year 2019 Enter the amount of $0

taxes paid into the tax increment fund for a reinvestment zone as agreed by the

taxing unit. If the taxing unit has no 2020 captured appraised value in Line 18D,

enter 0.[9]

17. Adjusted 2019 levy with refunds and TIF adjustment. Add Lines 14, and 15, $22,457,688

subtract Line 16.

18. Total 2020 taxable value on the 2020 certified appraisal roll today. This value

includes only certified values or certified estimate of values and includes the total

taxable value of homesteads with tax ceilings (will deduct in Line 20). These

homesteads include homeowners age 65 or older or disabled.[11]

A.Certified values $4,687,454,737

B. Counties Include railroad rolling stock values certified by the Comptroller's $0

office

C. Pollution control and energy storage system exemption Deduct the value of $0

property exempted for the current tax year for the first time as pollution control or

energy storage system property

D. Tax increment financing Deduct the 2020 captured appraised value of property $0

taxable by a taxing unit in a tax increment financing zone for which the 2020 taxes

will be deposited into the tax increment fund. Do not include any new property value

404

that will be included in Line 23 below.[12]

1001.1.6