Page 233 - FY 2009 Proposed Budget

P. 233

Debt Service Fund

of

Contents

Contents

Table

Table of Contents

of

Table

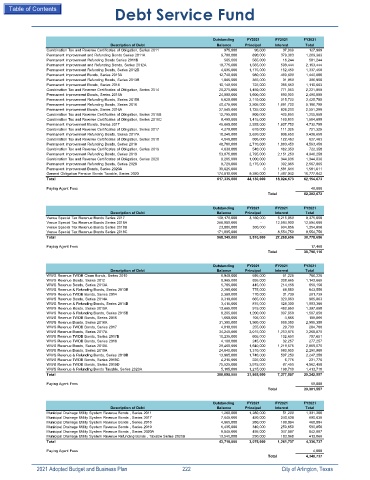

Outstanding FY2021 FY2021 FY2021

Description of Debt Balance Principal Interest Total

Combination Tax and Revenue Certificates of Obligation, Series 2011 975,000 90,000 37,969 127,969

Permanent Improvement and Refunding Bonds Series 2011A 9,790,000 890,000 379,363 1,269,363

Permanent Improvement Refunding Bonds Series 2011B 565,000 565,000 16,244 581,244

Permanent Improvement and Refunding Bonds, Series 2012A 18,775,000 1,565,000 598,444 2,163,444

Permanent Improvement Refunding Bonds, Series 2012B 4,635,000 1,175,000 162,450 1,337,450

Permanent Improvement Bonds, Series 2013A 12,740,000 980,000 460,600 1,440,600

Permanent Improvement Refunding Bonds, Series 2013B 1,065,000 365,000 31,950 396,950

Permanent Improvement Bonds, Series 2014 10,140,000 725,000 385,663 1,110,663

Combination Tax and Revenue Certificates of Obligation, Series 2014 20,270,000 1,450,000 771,050 2,221,050

Permanent Improvement Bonds, Series 2015A 24,000,000 1,600,000 890,000 2,490,000

Permanent Improvement Refunding Bonds, Series 2015B 9,820,000 2,110,000 315,700 2,425,700

Permanent Improvement Refunding Bonds, Series 2016 40,475,000 3,505,000 1,691,700 5,196,700

Permanent Improvement Bonds, Series 2016A 27,540,000 1,725,000 826,200 2,551,200

Combination Tax and Revenue Certificates of Obligation, Series 2016B 12,795,000 800,000 405,850 1,205,850

Combination Tax and Revenue Certificates of Obligation, Series 2016C 8,490,000 1,415,000 169,800 1,584,800

Permanent Improvement Bonds, Series 2017 49,665,000 2,925,000 1,807,750 4,732,750

Combination Tax and Revenue Certificates of Obligation, Series 2017 4,270,000 610,000 111,325 721,325

Permanent Improvement Refunding Bonds, Series 2017A 18,240,000 2,630,000 806,650 3,436,650

Combination Tax and Revenue Certificates of Obligation, Series 2018 4,040,000 505,000 122,463 627,463

Permanent Improvement Refunding Bonds, Series 2018 48,780,000 2,710,000 1,883,450 4,593,450

Combination Tax and Revenue Certificates of Obligation, Series 2019 4,830,000 540,000 182,350 722,350

Permanent Improvement Refunding Bonds, Series 2019 53,075,000 2,795,000 2,151,250 4,946,250

Combination Tax and Revenue Certificates of Obligation, Series 2020 9,205,000 1,000,000 344,836 1,344,836

Permanent Improvement Refunding Bonds, Series 2020 8,720,000 2,175,000 392,965 2,567,965

Permanent Improvement Bonds, Series 2020A 39,625,000 0 1,581,611 1,581,611

General Obligation Pension Bonds Taxable, Series 2020 174,810,000 9,280,000 1,497,042 10,777,042

Total 617,335,000 44,130,000 18,024,673 62,154,673

Paying Agent Fees 48,000

Total 62,202,673

Outstanding FY2021 FY2021 FY2021

Description of Debt Balance Principal Interest Total

Venue Special Tax Revenue Bonds Series 2017 108,170,000 3,160,000 5,215,050 8,375,050

Venue Special Tax Revenue Bonds Series 2018A 266,080,000 - 12,594,000 12,594,000

Venue Special Tax Revenue Bonds Series 2018B 23,000,000 350,000 904,856 1,254,856

Venue Special Tax Revenue Bonds Series 2018C 171,095,000 - 8,554,750 8,554,750

Total 568,345,000 3,510,000 27,268,656 30,778,656

Paying Agent Fees 17,460

Total 30,796,116

Outstanding FY2021 FY2021 FY2021

Description of Debt Balance Principal Interest Total

WWS Revenue TWDB Clean Bonds, Series 2010 6,940,000 695,000 91,225 786,225

WWS Revenue Bonds, Series 2012 9,965,000 835,000 308,665 1,143,665

WWS Revenue Bonds, Series 2013A 5,785,000 445,000 214,156 659,156

WWS Revenue & Refunding Bonds, Series 2013B 2,285,000 775,000 68,550 843,550

WWS Revenue TWDB Bonds, Series 2014 2,380,000 170,000 31,739 201,739

WWS Revenue Bonds, Series 2014A 9,310,000 665,000 320,863 985,863

WWS Revenue & Refunding Bonds, Series 2014B 3,415,000 875,000 128,300 1,003,300

WWS Revenue Bonds, Series 2015A 13,665,000 915,000 482,850 1,397,850

WWS Revenue & Refunding Bonds, Series 2015B 8,285,000 1,200,000 307,850 1,507,850

WWS Revenue TWDB Bonds, Series 2016 1,660,000 105,000 4,866 109,866

WWS Revenue Bonds, Series 2016A 31,350,000 1,960,000 999,350 2,959,350

WWS Revenue TWDB Bonds, Series 2017 4,010,000 255,000 29,700 284,700

WWS Revenue Bonds, Series 2017A 34,240,000 2,015,000 1,253,875 3,268,875

WWS Revenue TWDB Bonds, Series 2017B 10,235,000 605,000 102,651 707,651

WWS Revenue TWDB Bonds, Series 2018 4,160,000 245,000 32,257 277,257

WWS Revenue Bonds, Series 2018A 29,460,000 1,640,000 1,219,575 2,859,575

WWS Revenue Bonds, Series 2019A 24,840,000 1,310,000 980,900 2,290,900

WWS Revenue & Refunding Bonds, Series 2019B 13,985,000 1,740,000 507,250 2,247,250

WWS Revenue TWDB Bonds, Series 2019C 4,215,000 225,000 6,776 231,776

WWS Revenue TWDB Bonds, Series 2019D 75,525,000 3,975,000 87,450 4,062,450

WWS Revenue & Refunding Bonds Taxable, Series 2020A 5,185,000 1,215,000 198,710 1,413,710

Total 300,895,000 21,865,000 7,377,557 29,242,557

Paying Agent Fees 59,000

Total 29,301,557

Outstanding FY2021 FY2021 FY2021

Description of Debt Balance Principal Interest Total

Municipal Drainage Utility System Revenue Bonds , Series 2011 1,280,000 1,280,000 51,200 1,331,200

Municipal Drainage Utility System Revenue Bonds , Series 2017 7,645,000 450,000 240,638 690,638

Municipal Drainage Utility System Revenue Bonds , Series 2018 4,965,000 280,000 188,094 468,094

Municipal Drainage Utility System Revenue Bonds , Series 2019 6,435,000 340,000 250,850 590,850

Municipal Drainage Utility System Revenue Bonds , Series 2020A 9,845,000 495,000 347,887 842,887

Municipal Drainage Utility System Revenue Refunding Bonds , Taxable Series 2020B 13,540,000 230,000 183,068 413,068

Total 43,710,000 3,075,000 1,261,737 4,336,737

Paying Agent Fees 4,000

Total 4,340,737

2021 Adopted Budget and Business Plan 222 City of Arlington, Texas