Page 330 - Southlake FY20 Budget

P. 330

Sales Tax Districts

Special Revenue Funds

SALES TAx DISTRICTS

Community Enhancement and Development Corporation Fund

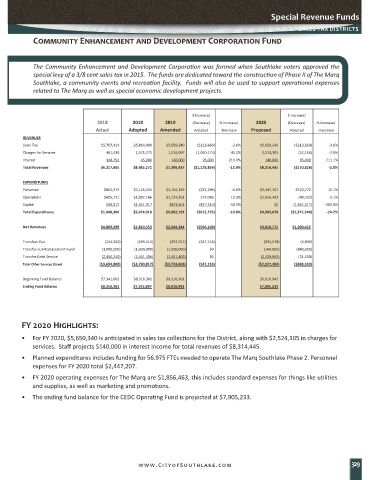

The Community Enhancement and Development Corporation was formed when Southlake voters approved the

CEDC - OPERATING FUND

special levy of a 3/8 cent sales tax in 2015. The funds are dedicated toward the construction of Phase II of The Marq

Southlake, a community events and recreation facility. Funds will also be used to support operational expenses

Parks/Recreation

related to The Marq as well as special economic development projects.

2020 Proposed and 2019 Revised Budget

07:03 PM

08/11/19

$ Increase/ $ Increase/

2018 2019 2019 (Decrease) % Increase/ 2020 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Sales Tax $5,707,414 $5,864,000 $5,650,340 ($213,660) -3.6% $5,650,340 ($213,660) -3.6%

Charges for Services 461,439 2,576,271 1,516,097 (1,060,174) -41.2% 2,524,105 (52,166) -2.0%

Interest 148,752 45,000 140,000 95,000 211.1% 140,000 95,000 211.1%

Total Revenues $6,317,605 $8,485,271 $7,306,437 ($1,178,834) -13.9% $8,314,445 ($170,826) -2.0%

EXPENDITURES

Personnel $802,973 $2,126,435 $2,104,139 ($22,296) -1.0% $2,447,207 $320,772 15.1%

Operations $605,721 $1,897,166 $2,134,251 237,085 12.5% $1,856,463 (40,703) -2.1%

Capital $39,612 $1,651,317 $823,803 (827,514) -50.1% $0 (1,651,317) -100.0%

Total Expenditures $1,448,306 $5,674,918 $5,062,193 ($612,725) -10.8% $4,303,670 ($1,371,248) -24.2%

Net Revenues $4,869,299 $2,810,353 $2,244,244 ($566,109) $4,010,775 $1,200,422

Transfers Out (244,560) (339,411) (292,257) ($47,153) (332,578) (6,833)

Transfer out-Replacement Fund (1,000,000) (1,000,000) (1,000,000) $0 (160,000) (840,000)

Transfer Debt Service (2,450,240) (2,451,406) (2,451,406) $0 (2,429,906) (21,500)

Total Other Sources (Uses) ($3,694,800) ($3,790,817) ($3,743,663) ($47,153) ($2,922,484) ($868,333)

Beginning Fund Balance $7,141,862 $8,316,361 $8,316,361 $6,816,942

Ending Fund Balance $8,316,361 $7,335,897 $6,816,942 $7,905,233

FY 2020 Highlights:

• For FY 2020, $5,650,340 is anticipated in sales tax collections for the District, along with $2,524,105 in charges for

services. Staff projects $140,000 in interest income for total revenues of $8,314,445.

• Planned expenditures includes funding for 56.975 FTEs needed to operate The Marq Southlake Phase 2. Personnel

expenses for FY 2020 total $2,447,207.

• FY 2020 operating expenses for The Marq are $1,856,463, this includes standard expenses for things like utilities

and supplies, as well as marketing and promotions.

• The ending fund balance for the CEDC Operating Fund is projected at $7,905,233.

www.CityofSouthlake.com 329