Page 222 - Saginaw FY20 Annual Budget

P. 222

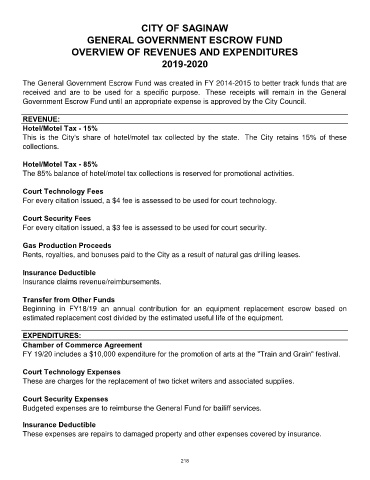

CITY OF SAGINAW

GENERAL GOVERNMENT ESCROW FUND

OVERVIEW OF REVENUES AND EXPENDITURES

2019-2020

The General Government Escrow Fund was created in FY 2014-2015 to better track funds that are

received and are to be used for a specific purpose. These receipts will remain in the General

Government Escrow Fund until an appropriate expense is approved by the City Council.

REVENUE:

Hotel/Motel Tax - 15%

This is the City's share of hotel/motel tax collected by the state. The City retains 15% of these

collections.

Hotel/Motel Tax - 85%

The 85% balance of hotel/motel tax collections is reserved for promotional activities.

Court Technology Fees

For every citation issued, a $4 fee is assessed to be used for court technology.

Court Security Fees

For every citation issued, a $3 fee is assessed to be used for court security.

Gas Production Proceeds

Rents, royalties, and bonuses paid to the City as a result of natural gas drilling leases.

Insurance Deductible

Insurance claims revenue/reimbursements.

Transfer from Other Funds

Beginning in FY18/19 an annual contribution for an equipment replacement escrow based on

estimated replacement cost divided by the estimated useful life of the equipment.

EXPENDITURES:

Chamber of Commerce Agreement

FY 19/20 includes a $10,000 expenditure for the promotion of arts at the "Train and Grain" festival.

Court Technology Expenses

These are charges for the replacement of two ticket writers and associated supplies.

Court Security Expenses

Budgeted expenses are to reimburse the General Fund for bailiff services.

Insurance Deductible

These expenses are repairs to damaged property and other expenses covered by insurance.

218