Page 63 - Mansfieldr FY20 Approved Budget

P. 63

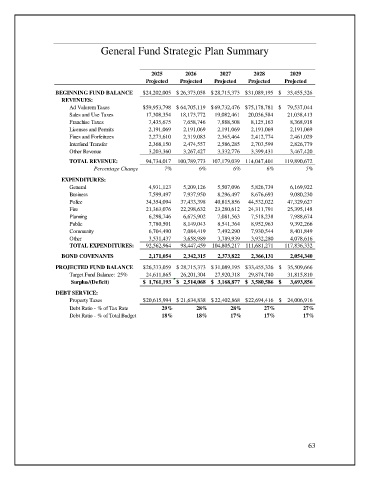

General Fund Strategic Plan Summary

2025 2026 2027 2028 2029

Projected Projected Projected Projected Projected

BEGINNING FUND BALANCE $ 24,202,005 $ 26,373,058 $ 28,715,373 $ 31,089,195 $ 33,455,326

REVENUES:

Ad Valorem Taxes $ 59,953,798 $ 64,705,119 $ 69,732,476 $ 75,178,781 $ 79,537,044

Sales and Use Taxes 17,308,354 18,173,772 19,082,461 20,036,584 21,038,413

Franchise Taxes 7,435,675 7,658,746 7,888,508 8,125,163 8,368,918

Licenses and Permits 2,191,069 2,191,069 2,191,069 2,191,069 2,191,069

Fines and Forfeitures 2,273,610 2,319,083 2,365,464 2,412,774 2,461,029

Interfund Transfer 2,368,150 2,474,557 2,586,285 2,703,599 2,826,779

Other Revenue 3,203,360 3,267,427 3,332,776 3,399,431 3,467,420

TOTAL REVENUE: 94,734,017 100,789,773 107,179,039 114,047,401 119,890,672

Percentage Change 7% 6% 6% 6% 5%

EXPENDITURES:

General 4,931,123 5,209,126 5,507,096 5,826,739 6,169,922

Business 7,599,497 7,937,950 8,296,497 8,676,693 9,080,230

Police 34,354,094 37,433,398 40,815,856 44,532,022 47,329,627

Fire 21,363,076 22,298,632 23,280,612 24,311,791 25,395,148

Planning 6,298,746 6,675,902 7,081,563 7,518,238 7,988,674

Public 7,780,501 8,149,043 8,541,364 8,952,963 9,392,266

Community 6,704,490 7,084,419 7,492,290 7,930,544 8,401,849

Other 3,531,437 3,658,989 3,789,939 3,932,280 4,078,616

TOTAL EXPENDITURES: 92,562,964 98,447,459 104,805,217 111,681,271 117,836,332

BOND COVENANTS 2,171,054 2,342,315 2,373,822 2,366,131 2,054,340

PROJECTED FUND BALANCE $ 26,373,059 $ 28,715,373 $ 31,089,195 $ 33,455,326 $ 35,509,666

Target Fund Balance: 25% 24,611,865 26,201,304 27,920,318 29,874,740 31,815,810

Surplus/(Deficit) $ 1,761,193 $ 2,514,068 $ 3,168,877 $ 3,580,586 $ 3,693,856

DEBT SERVICE:

Property Taxes $ 20,615,994 $ 21,634,838 $ 22,402,868 $ 22,694,416 $ 24,006,916

Debt Ratio - % of Tax Rate 29% 28% 28% 27% 27%

Debt Ratio - % of Total Budget 18% 18% 17% 17% 17%

63