Page 62 - Mansfieldr FY20 Approved Budget

P. 62

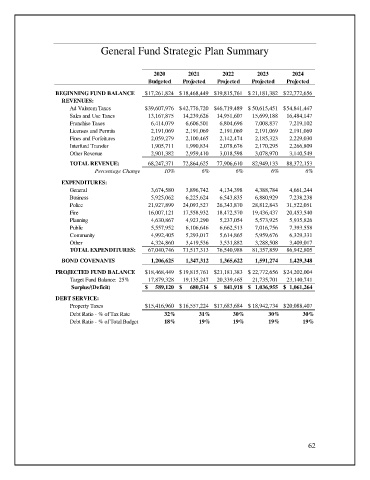

General Fund Strategic Plan Summary

2020 2021 2022 2023 2024

Budgeted Projected Projected Projected Projected

BEGINNING FUND BALANCE $ 17,261,824 $ 18,468,449 $ 19,815,761 $ 21,181,382 $ 22,772,656

REVENUES:

Ad Valorem Taxes $ 39,607,976 $ 42,776,720 $ 46,719,489 $ 50,615,451 $ 54,841,447

Sales and Use Taxes 13,167,875 14,239,626 14,951,607 15,699,188 16,484,147

Franchise Taxes 6,414,079 6,606,501 6,804,696 7,008,837 7,219,102

Licenses and Permits 2,191,069 2,191,069 2,191,069 2,191,069 2,191,069

Fines and Forfeitures 2,059,279 2,100,465 2,142,474 2,185,323 2,229,030

Interfund Transfer 1,905,711 1,990,834 2,078,676 2,170,295 2,266,809

Other Revenue 2,901,382 2,959,410 3,018,598 3,078,970 3,140,549

TOTAL REVENUE: 68,247,371 72,864,625 77,906,610 82,949,133 88,372,153

Percentage Change 10% 6% 6% 6% 6%

EXPENDITURES:

General 3,674,580 3,896,742 4,134,398 4,388,784 4,661,244

Business 5,925,062 6,225,624 6,543,835 6,880,929 7,238,238

Police 21,927,899 24,093,527 26,343,870 28,812,843 31,522,051

Fire 16,007,121 17,558,932 18,472,570 19,436,437 20,453,540

Planning 4,630,867 4,923,290 5,237,054 5,573,925 5,935,826

Public 5,557,952 6,106,646 6,662,513 7,016,756 7,393,558

Community 4,992,405 5,293,017 5,614,865 5,959,676 6,329,331

Other 4,324,860 3,419,536 3,531,882 3,288,508 3,409,017

TOTAL EXPENDITURES: 67,040,746 71,517,313 76,540,988 81,357,859 86,942,805

BOND COVENANTS 1,206,625 1,347,312 1,365,622 1,591,274 1,429,348

PROJECTED FUND BALANCE $ 18,468,449 $ 19,815,761 $ 21,181,383 $ 22,772,656 $ 24,202,004

Target Fund Balance: 25% 17,879,328 19,135,247 20,339,465 21,735,701 23,140,741

Surplus/(Deficit) $ 589,120 $ 680,514 $ 841,918 $ 1,036,955 $ 1,061,264

DEBT SERVICE:

Property Taxes $ 15,416,960 $ 16,557,224 $ 17,683,684 $ 18,942,734 $ 20,088,407

Debt Ratio - % of Tax Rate 32% 31% 30% 30% 30%

Debt Ratio - % of Total Budget 18% 19% 19% 19% 19%

62