Page 299 - Mansfieldr FY20 Approved Budget

P. 299

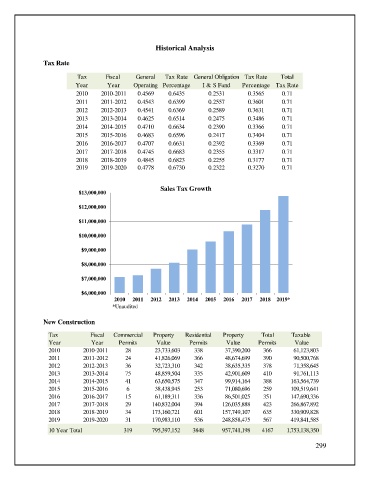

Historical Analysis

Tax Rate

Tax Fiscal General Tax Rate General Obligation Tax Rate Total

Year Year Operating Percentage I & S Fund Percentage Tax Rate

2010 2010-2011 0.4569 0.6435 0.2531 0.3565 0.71

2011 2011-2012 0.4543 0.6399 0.2557 0.3601 0.71

2012 2012-2013 0.4541 0.6369 0.2589 0.3631 0.71

2013 2013-2014 0.4625 0.6514 0.2475 0.3486 0.71

2014 2014-2015 0.4710 0.6634 0.2390 0.3366 0.71

2015 2015-2016 0.4683 0.6596 0.2417 0.3404 0.71

2016 2016-2017 0.4707 0.6631 0.2392 0.3369 0.71

2017 2017-2018 0.4745 0.6683 0.2355 0.3317 0.71

2018 2018-2019 0.4845 0.6823 0.2255 0.3177 0.71

2019 2019-2020 0.4778 0.6730 0.2322 0.3270 0.71

Sales Tax Growth

$13,000,000

$12,000,000

$11,000,000

$10,000,000

$9,000,000

$8,000,000

$7,000,000

$6,000,000

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019*

*Unaudited

New Construction

Tax Fiscal Commercial Property Residential Property Total Taxable

Year Year Permits Value Permits Value Permits Value

2010 2010-2011 28 23,733,603 338 37,390,200 366 61,123,803

2011 2011-2012 24 41,826,069 366 48,674,699 390 90,500,768

2012 2012-2013 36 32,723,310 342 38,635,335 378 71,358,645

2013 2013-2014 75 48,859,504 335 42,901,609 410 91,761,113

2014 2014-2015 41 63,650,575 347 99,914,164 388 163,564,739

2015 2015-2016 6 38,438,945 253 71,080,696 259 109,519,641

2016 2016-2017 15 61,189,311 336 86,501,025 351 147,690,336

2017 2017-2018 29 140,832,004 394 126,035,888 423 266,867,892

2018 2018-2019 34 173,160,721 601 157,749,107 635 330,909,828

2019 2019-2020 31 170,983,110 536 248,858,475 567 419,841,585

10 Year Total 319 795,397,152 3848 957,741,198 4167 1,753,138,350

299