Page 180 - Hurst FY20 Approved Budget

P. 180

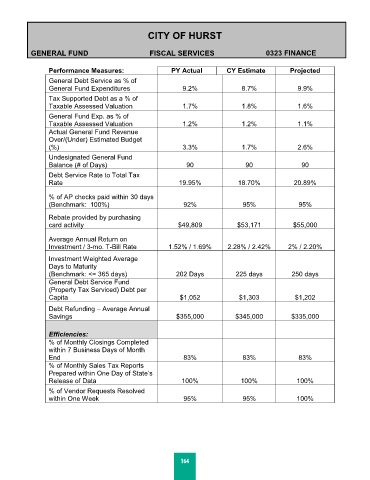

CITY OF HURST

GENERAL FUND FISCAL SERVICES 0323 FINANCE

Performance Measures: PY Actual CY Estimate Projected

General Debt Service as % of

General Fund Expenditures 9.2% 8.7% 9.9%

Tax Supported Debt as a % of

Taxable Assessed Valuation 1.7% 1.8% 1.6%

General Fund Exp. as % of

Taxable Assessed Valuation 1.2% 1.2% 1.1%

Actual General Fund Revenue

Over/(Under) Estimated Budget

(%) 3.3% 1.7% 2.6%

Undesignated General Fund

Balance (# of Days) 90 90 90

Debt Service Rate to Total Tax

Rate 19.95% 18.70% 20.89%

% of AP checks paid within 30 days

(Benchmark: 100%) 92% 95% 95%

Rebate provided by purchasing

card activity $49,809 $53,171 $55,000

Average Annual Return on

Investment / 3-mo. T-Bill Rate 1.52% / 1.69% 2.28% / 2.42% 2% / 2.20%

Investment Weighted Average

Days to Maturity

(Benchmark: <= 365 days) 202 Days 225 days 250 days

General Debt Service Fund

(Property Tax Serviced) Debt per

Capita $1,052 $1,303 $1,202

Debt Refunding – Average Annual

Savings $355,000 $345,000 $335,000

Efficiencies:

% of Monthly Closings Completed

within 7 Business Days of Month

End 83% 83% 83%

% of Monthly Sales Tax Reports

Prepared within One Day of State’s

Release of Data 100% 100% 100%

% of Vendor Requests Resolved

within One Week 95% 95% 100%

164

98