Page 178 - Hurst FY20 Approved Budget

P. 178

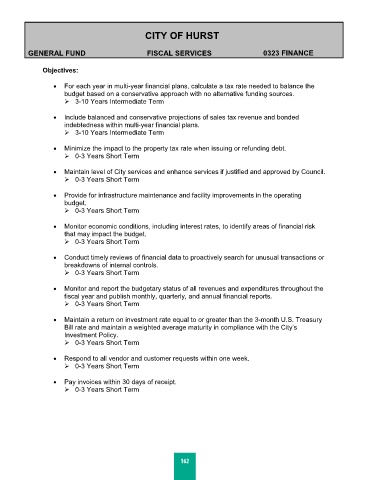

CITY OF HURST

GENERAL FUND FISCAL SERVICES 0323 FINANCE

Objectives:

• For each year in multi-year financial plans, calculate a tax rate needed to balance the

budget based on a conservative approach with no alternative funding sources.

3-10 Years Intermediate Term

• Include balanced and conservative projections of sales tax revenue and bonded

indebtedness within multi-year financial plans.

3-10 Years Intermediate Term

• Minimize the impact to the property tax rate when issuing or refunding debt.

0-3 Years Short Term

• Maintain level of City services and enhance services if justified and approved by Council.

0-3 Years Short Term

• Provide for infrastructure maintenance and facility improvements in the operating

budget.

0-3 Years Short Term

• Monitor economic conditions, including interest rates, to identify areas of financial risk

that may impact the budget.

0-3 Years Short Term

• Conduct timely reviews of financial data to proactively search for unusual transactions or

breakdowns of internal controls.

0-3 Years Short Term

• Monitor and report the budgetary status of all revenues and expenditures throughout the

fiscal year and publish monthly, quarterly, and annual financial reports.

0-3 Years Short Term

• Maintain a return on investment rate equal to or greater than the 3-month U.S. Treasury

Bill rate and maintain a weighted average maturity in compliance with the City’s

Investment Policy.

0-3 Years Short Term

• Respond to all vendor and customer requests within one week.

0-3 Years Short Term

• Pay invoices within 30 days of receipt.

0-3 Years Short Term

162

96