Page 53 - Grapevine FY20 Approved Budget

P. 53

Goal Result

Sustain existing program service levels Yes; No reductions in service

levels projected

Maintain General Fund balance of at least 20% annually Yes; FY20 projected ending

balance is 26%

th

Maintain competitive employee compensation at the 50 Yes; FY20 budget includes 3%

percentile of the market merit / 5% step pay increases

Adequate and stable street / facility maintenance funding Yes; FY20 budget restores full

funding of PCMF/PSMF

Cash funding of fleet, capital and technology equipment Yes; No debt issuance for fleet

replacements or equipment replacements

Cap debt service at 25% of the General Fund budget Yes; FY20 ratio is 19%

Use excess reserves to invest in “Quality of Life” capital Yes; Estimated $3 million

projects investment in FY20

Current Economic Trends Impacting Long-Range Forecasting

Although some economic indicators point toward an upturn in the national economy, many

uncertainties still exist within the financial realm. The City’s initial forecast, completed five

years ago, assumed a relatively stable economy, low unemployment, and moderate growth in

both sales and property taxes. However, with an extended lag in retail sales, combined with

elevated foreclosure rates and a slowdown in job growth within the DFW Metroplex, the task of

long-range planning has become much more important, as well as much more difficult.

Within the last twelve months, sales tax collections citywide increased by $3.4 million (6.1%),

which followed a $2.1 million (4%) increase the previous year. Now three years removed from

the dramatic $2 million loss in FY17, sales tax are projected to increase at a more moderate pace

of 2% annually through the three-year outlook.

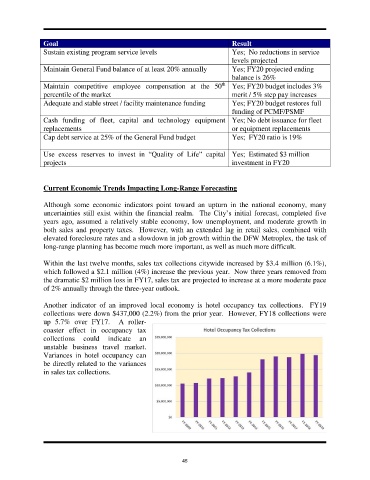

Another indicator of an improved local economy is hotel occupancy tax collections. FY19

collections were down $437,000 (2.2%) from the prior year. However, FY18 collections were

up 5.7% over FY17. A roller-

coaster effect in occupancy tax

collections could indicate an

unstable business travel market.

Variances in hotel occupancy can

be directly related to the variances

in sales tax collections.

45