Page 51 - Grapevine FY20 Approved Budget

P. 51

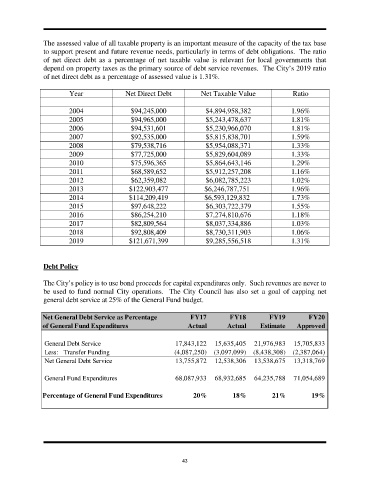

The assessed value of all taxable property is an important measure of the capacity of the tax base

to support present and future revenue needs, particularly in terms of debt obligations. The ratio

of net direct debt as a percentage of net taxable value is relevant for local governments that

depend on property taxes as the primary source of debt service revenues. The City’s 2019 ratio

of net direct debt as a percentage of assessed value is 1.31%.

Year Net Direct Debt Net Taxable Value Ratio

2004 $94,245,000 $4,894,958,382 1.96%

2005 $94,965,000 $5,243,478,637 1.81%

2006 $94,531,601 $5,230,966,070 1.81%

2007 $92,535,000 $5,815,838,701 1.59%

2008 $79,538,716 $5,954,088,371 1.33%

2009 $77,725,000 $5,829,604,089 1.33%

2010 $75,596,365 $5,864,643,146 1.29%

2011 $68,589,652 $5,912,257,208 1.16%

2012 $62,359,082 $6,082,785,223 1.02%

2013 $122,903,477 $6,246,787,751 1.96%

2014 $114,209,419 $6,593,129,832 1.73%

2015 $97,648,222 $6,303,722,379 1.55%

2016 $86,254,210 $7,274,810,676 1.18%

2017 $82,809,564 $8,037,334,886 1.03%

2018 $92,808,409 $8,730,311,903 1.06%

2019 $121,671,399 $9,285,556,518 1.31%

Debt Policy

The City’s policy is to use bond proceeds for capital expenditures only. Such revenues are never to

be used to fund normal City operations. The City Council has also set a goal of capping net

general debt service at 25% of the General Fund budget.

Net General Debt Service as Percentage FY17 FY18 FY19 FY20

of General Fund Expenditures Actual Actual Estimate Approved

General Debt Service 17,843,122 15,635,405 21,976,983 15,705,833

Less: Transfer Funding (4,087,250) (3,097,099) (8,438,308) (2,387,064)

Net General Debt Service 13,755,872 12,538,306 13,538,675 13,318,769

General Fund Expenditures 68,087,933 68,932,685 64,235,788 71,054,689

Percentage of General Fund Expenditures 20% 18% 21% 19%

43