Page 47 - Grapevine FY20 Approved Budget

P. 47

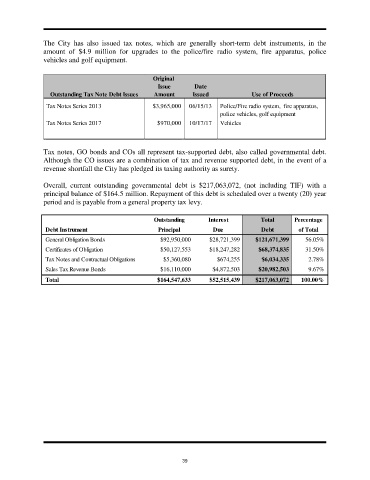

The City has also issued tax notes, which are generally short-term debt instruments, in the

amount of $4.9 million for upgrades to the police/fire radio system, fire apparatus, police

vehicles and golf equipment.

Original

Issue Date

Outstanding Tax Note Debt Issues Amount Issued Use of Proceeds

Tax Notes Series 2013 $3,965,000 06/15/13 Police/Fire radio system, fire apparatus,

police vehicles, golf equipment

Tax Notes Series 2017 $970,000 10/17/17 Vehicles

Tax notes, GO bonds and COs all represent tax-supported debt, also called governmental debt.

Although the CO issues are a combination of tax and revenue supported debt, in the event of a

revenue shortfall the City has pledged its taxing authority as surety.

Overall, current outstanding governmental debt is $217,063,072, (not including TIF) with a

principal balance of $164.5 million. Repayment of this debt is scheduled over a twenty (20) year

period and is payable from a general property tax levy.

Outstanding Interest Total Percentage

Debt Instrument Principal Due Debt of Total

General Obligation Bonds $92,950,000 $28,721,399 $121,671,399 56.05%

Certificates of Obligation $50,127,553 $18,247,282 $68,374,835 31.50%

Tax Notes and Contractual Obligations $5,360,080 $674,255 $6,034,335 2.78%

Sales Tax Revenue Bonds $16,110,000 $4,872,503 $20,982,503 9.67%

Total $164,547,633 $52,515,439 $217,063,072 100.00%

39