Page 132 - Grapevine FY20 Approved Budget

P. 132

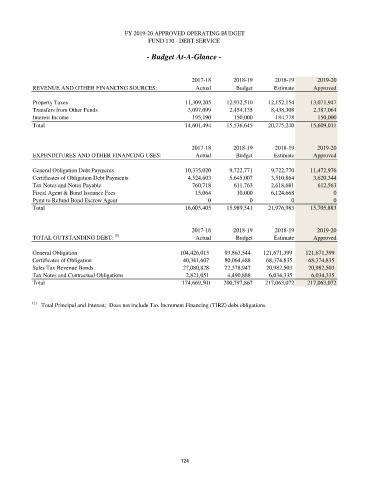

FY 2019-20 APPROVED OPERATING BUDGET

FUND 130 - DEBT SERVICE

- Budget At-A-Glance -

2017-18 2018-19 2018-19 2019-20

REVENUE AND OTHER FINANCING SOURCES: Actual Budget Estimate Approved

Property Taxes 11,309,205 12,932,510 12,152,154 13,071,947

Transfers from Other Funds 3,097,099 2,454,135 8,438,308 2,387,064

Interest Income 195,190 150,000 184,778 150,000

Total 14,601,494 15,536,645 20,775,240 15,609,011

2017-18 2018-19 2018-19 2019-20

EXPENDITURES AND OTHER FINANCING USES: Actual Budget Estimate Approved

General Obligation Debt Payments 10,335,020 9,722,771 9,722,770 11,472,976

Certificates of Obligation Debt Payments 4,524,603 5,645,007 3,510,864 3,620,344

Tax Notes and Notes Payable 760,718 611,763 2,618,681 612,563

Fiscal Agent & Bond Issuance Fees 15,064 10,000 6,124,668 0

Pymt to Refund Bond Escrow Agent 0 0 0 0

Total 16,605,405 15,989,541 21,976,983 15,705,883

2017-18 2018-19 2018-19 2019-20

TOTAL OUTSTANDING DEBT: (1) Actual Budget Estimate Approved

General Obligation 104,426,015 93,863,544 121,671,399 121,671,399

Certificates of Obligation 40,341,607 80,064,488 68,374,835 68,374,835

Sales Tax Revenue Bonds 27,080,828 22,378,947 20,982,503 20,982,503

Tax Notes and Contractual Obligations 2,821,051 4,490,888 6,034,335 6,034,335

Total 174,669,501 200,797,867 217,063,072 217,063,072

(1) Total Principal and Interest; Does not include Tax Increment Financing (TIRZ) debt obligations.

124