Page 197 - FY2020Colleyville

P. 197

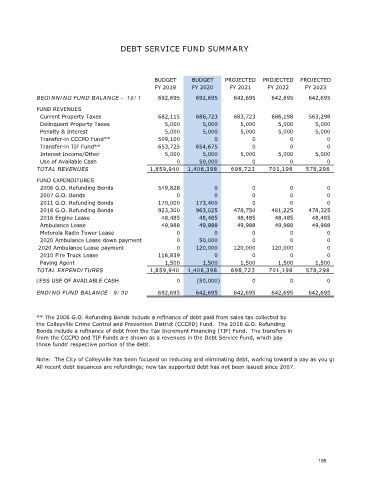

DEBT SERVICE FUND SUMMARY

BUDGET BUDGET PROJECTED PROJECTED PROJECTED

FY 2019 FY 2020 FY 2021 FY 2022 FY 2023

BEGINNING FUND BALANCE - 10/1 692,695 692,695 642,695 642,695 642,695

FUND REVENUES

Current Property Taxes 682,115 686,723 683,723 686,198 563,298

Delinquent Property Taxes 5,000 5,000 5,000 5,000 5,000

Penalty & Interest 5,000 5,000 5,000 5,000 5,000

Transfer-in CCCPD Fund** 509,100 0 0 0 0

Transfer-in TIF Fund** 653,725 654,675 0 0 0

Interest Income/Other 5,000 5,000 5,000 5,000 5,000

Use of Available Cash 0 50,000 0 0 0

TOTAL REVENUES 1,859,940 1,406,398 698,723 701,198 578,298

FUND EXPENDITURES

2006 G.O. Refunding Bonds 549,828 0 0 0 0

2007 G.O. Bonds 0 0 0 0 0

2011 G.O. Refunding Bonds 170,000 173,400 0 0 0

2016 G.O. Refunding Bonds 923,300 963,025 478,750 481,225 478,325

2016 Engine Lease 48,485 48,485 48,485 48,485 48,485

Ambulance Lease 49,988 49,988 49,988 49,988 49,988

Motorola Radio Tower Lease 0 0 0 0 0

2020 Ambulance Lease down payment 0 50,000 0 0 0

2020 Ambulance Lease payment 0 120,000 120,000 120,000 0

2010 Fire Truck Lease 116,839 0 0 0 0

Paying Agent 1,500 1,500 1,500 1,500 1,500

TOTAL EXPENDITURES 1,859,940 1,406,398 698,723 701,198 578,298

LESS USE OF AVAILABLE CASH 0 (50,000) 0 0 0

ENDING FUND BALANCE - 9/30 692,695 642,695 642,695 642,695 642,695

** The 2006 G.O. Refunding Bonds include a refinance of debt paid from sales tax collected by

the Colleyville Crime Control and Prevention District (CCCPD) Fund. The 2016 G.O. Refunding

Bonds include a refinance of debt from the Tax Increment Financing (TIF) Fund. The transfers in

from the CCCPD and TIF Funds are shown as a revenues in the Debt Service Fund, which pay

those funds' respective portion of the debt.

Note: The City of Colleyville has been focused on reducing and eliminating debt, working toward a pay as you go

All recent debt issuances are refundings; new tax supported debt has not been issued since 2007.

195