Page 435 - City of Bedford FY20 Approved Budget

P. 435

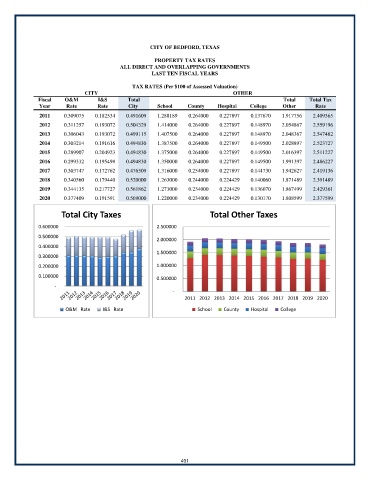

CITY OF BEDFORD, TEXAS

PROPERTY TAX RATES

ALL DIRECT AND OVERLAPPING GOVERNMENTS

LAST TEN FISCAL YEARS

TAX RATES (Per $100 of Assessed Valuation)

CITY OTHER

Fiscal O&M I&S Total Total Total Tax

Year Rate Rate City School County Hospital College Other Rate

2011 0.309075 0.182534 0.491609 1.288189 0.264000 0.227897 0.137670 1.917756 2.409365

2012 0.311257 0.193072 0.504329 1.414000 0.264000 0.227897 0.148970 2.054867 2.559196

2013 0.306043 0.193072 0.499115 1.407500 0.264000 0.227897 0.148970 2.048367 2.547482

2014 0.303214 0.191616 0.494830 1.387500 0.264000 0.227897 0.149500 2.028897 2.523727

2015 0.289907 0.204923 0.494830 1.375000 0.264000 0.227897 0.149500 2.016397 2.511227

2016 0.299332 0.195498 0.494830 1.350000 0.264000 0.227897 0.149500 1.991397 2.486227

2017 0.303747 0.172762 0.476509 1.316000 0.254000 0.227897 0.144730 1.942627 2.419136

2018 0.340560 0.179440 0.520000 1.263000 0.244000 0.224429 0.140060 1.871489 2.391489

2019 0.344135 0.217727 0.561862 1.273000 0.234000 0.224429 0.136070 1.867499 2.429361

2020 0.377409 0.191591 0.569000 1.220000 0.234000 0.224429 0.130170 1.808599 2.377599

Total City Taxes Total Other Taxes

0.600000 2.500000

0.500000

2.000000

0.400000

1.500000

0.300000

0.200000 1.000000

0.100000 0.500000

-

-

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

O&M Rate I&S Rate School County Hospital College

401