Page 432 - City of Bedford FY20 Approved Budget

P. 432

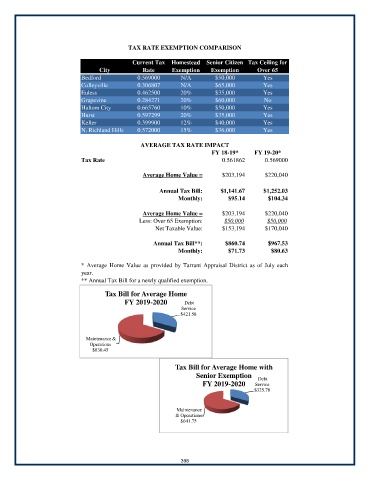

TAX RATE EXEMPTION COMPARISON

Current Tax Homestead Senior Citizen Tax Ceiling for

City Rate Exemption Exemption Over 65

Bedford 0.569000 N/A $50,000 Yes

Colleyville 0.306807 N/A $65,000 Yes

Euless 0.462500 20% $35,000 Yes

Grapevine 0.284271 20% $60,000 No

Haltom City 0.665760 10% $50,000 Yes

Hurst 0.597299 20% $35,000 Yes

Keller 0.399900 12% $40,000 Yes

N. Richland Hills 0.572000 15% $36,000 Yes

AVERAGE TAX RATE IMPACT

FY 18-19* FY 19-20*

Tax Rate 0.561862 0.569000

Average Home Value = $203,194 $220,040

Annual Tax Bill: $1,141.67 $1,252.03

Monthly: $95.14 $104.34

Average Home Value = $203,194 $220,040

Less: Over 65 Exemption: $50,000 $50,000

Net Taxable Value: $153,194 $170,040

Annual Tax Bill**: $860.74 $967.53

Monthly: $71.73 $80.63

* Average Home Value as provided by Tarrant Appraisal District as of July each

year.

** Annual Tax Bill for a newly qualified exemption.

Tax Bill for Average Home

FY 2019-2020 Debt

Service

$421.58

Maintenance &

Operations

$830.45

Tax Bill for Average Home with

Senior Exemption Debt

FY 2019-2020 Service

$325.78

Maintenance

& Operations

$641.75

398