Page 74 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 74

Section 2 Financial Analysis

Budget 101 Overview

All assets and all liabilities associated with the operation of these funds are included on

the combined statement of net assets. Net assets are segregated into net assets invested

in capital assets, net of related debt, restricted net assets and un-invested net assets.

Proprietary fund-type operating statements present increases ( revenues) and decreases

expenses) in total net assets.

For purposes of this budget presentation, depreciation is not displayed and capital

expenditures and bond principal payments are shown as uses of funds.

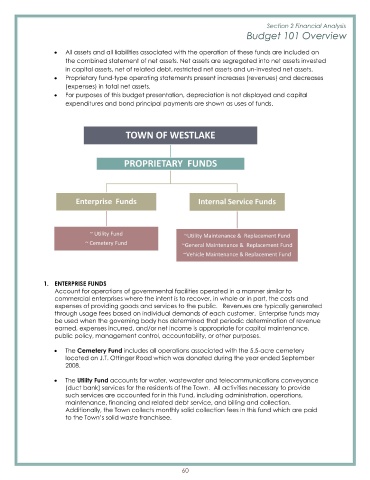

TOWN OF WESTLAKE

PROPRIETARY FUNDS

Enterprise Funds Internal Service Funds

Utility Fund Utility Maintenance & Replacement Fund

Cemetery Fund General Maintenance & Replacement Fund

Vehicle Maintenance & Replacement Fund

1. ENTERPRISE FUNDS

Account for operations of governmental facilities operated in a manner similar to

commercial enterprises where the intent is to recover, in whole or in part, the costs and

expenses of providing goods and services to the public. Revenues are typically generated

through usage fees based on individual demands of each customer. Enterprise funds may

be used when the governing body has determined that periodic determination of revenue

earned, expenses incurred, and/ or net income is appropriate for capital maintenance,

public policy, management control, accountability, or other purposes.

The Cemetery Fund includes all operations associated with the 5.5-acre cemetery

located on J.T. Ottinger Road which was donated during the year ended September

2008.

The Utility Fund accounts for water, wastewater and telecommunications conveyance

duct bank) services for the residents of the Town. All activities necessary to provide

such services are accounted for in this Fund, including administration, operations,

maintenance, financing and related debt service, and billing and collection.

Additionally, the Town collects monthly solid collection fees in this fund which are paid

to the Town’ s solid waste franchisee.

60