Page 71 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 71

Section 2 Financial Analysis

Budget 101 Overview

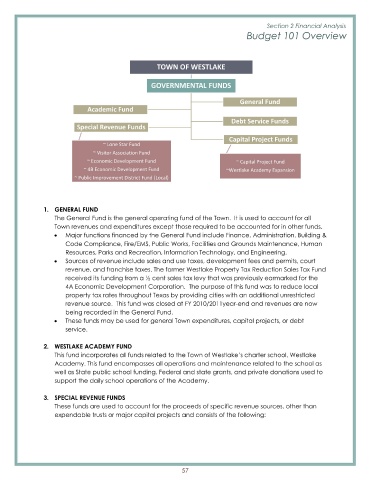

TOWN OF WESTLAKE

GOVERNMENTAL FUNDS

General Fund

Academic Fund

Debt Service

FundsSpecial

Revenue

Funds

Capital Project Funds

Lone Star Fund

Visitor Association Fund

Economic Development Fund Capital Project Fund

4B Economic Development Fund Westlake Academy Expansion

Public Improvement District Fund ( Local)

1. GENERAL FUND

The General Fund is the general operating fund of the Town. It is used to account for all

Town revenues and expenditures except those required to be accounted for in other funds.

Major functions financed by the General Fund include Finance, Administration, Building &

Code Compliance, Fire/ EMS, Public Works, Facilities and Grounds Maintenance, Human

Resources, Parks and Recreation, Information Technology, and Engineering.

Sources of revenue include sales and use taxes, development fees and permits, court

revenue, and franchise taxes. The former Westlake Property Tax Reduction Sales Tax Fund

received its funding from a ½ cent sales tax levy that was previously earmarked for the

4A Economic Development Corporation. The purpose of this fund was to reduce local

property tax rates throughout Texas by providing cities with an additional unrestricted

revenue source. This fund was closed at FY 2010/ 2011year- end and revenues are now

being recorded in the General Fund.

These funds may be used for general Town expenditures, capital projects, or debt

service.

2. WESTLAKE ACADEMY FUND

This fund incorporates all funds related to the Town of Westlake’ s charter school, Westlake

Academy. This fund encompasses all operations and maintenance related to the school as

well as State public school funding, Federal and state grants, and private donations used to

support the daily school operations of the Academy.

3. SPECIAL REVENUE FUNDS

These funds are used to account for the proceeds of specific revenue sources, other than

expendable trusts or major capital projects and consists of the following:

57