Page 248 - Saginaw FY19 Annual Budget

P. 248

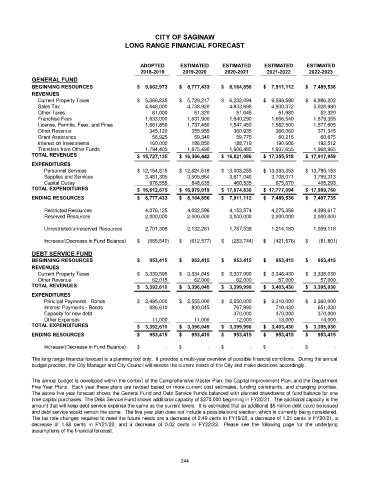

CITY OF SAGINAW

LONG RANGE FINANCIAL FORECAST

ADOPTED ESTIMATED ESTIMATED ESTIMATED ESTIMATED

2018-2019 2019-2020 2020-2021 2021-2022 2022-2023

GENERAL FUND

BEGINNING RESOURCES $ 9,662,973 $ 8,777,433 $ 8,164,856 $ 7,911,112 $ 7,489,536

REVENUES

Current Property Taxes $ 5,366,835 $ 5,729,217 $ 6,232,094 $ 6,599,590 $ 6,986,202

Sales Tax 4,646,000 4,738,920 4,833,698 4,930,372 5,028,980

Other Taxes 61,000 51,320 51,645 51,980 52,320

Franchise Fees 1,633,000 1,631,900 1,640,290 1,656,540 1,679,355

License, Permits, Fees, and Fines 1,661,850 1,737,450 1,547,450 1,562,500 1,577,605

Other Revenue 345,120 355,955 360,935 366,060 371,345

Grant Assistance 58,925 59,340 59,775 60,215 60,675

Interest on Investments 160,000 186,850 188,719 190,606 192,512

Transfers from Other Funds 1,794,405 1,875,490 1,906,480 1,937,655 1,968,965

TOTAL REVENUES $ 15,727,135 $ 16,366,442 $ 16,821,086 $ 17,355,518 $ 17,917,959

EXPENDITURES

Personnel Services $ 12,154,815 $ 12,624,519 $ 13,003,255 $ 13,393,353 $ 13,795,153

Supplies and Services 3,481,305 3,505,864 3,611,040 3,708,071 3,799,313

Capital Outlay 976,555 848,635 460,535 675,670 405,293

TOTAL EXPENDITURES $ 16,612,675 $ 16,979,019 $ 17,074,830 $ 17,777,094 $ 17,999,760

ENDING RESOURCES $ 8,777,433 $ 8,164,856 $ 7,911,112 $ 7,489,536 $ 7,407,735

Restricted Resources 4,076,125 4,032,596 4,153,574 4,275,356 4,398,617

Reserved Resources 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000

Unrestricted/unreserved Resources 2,701,308 2,132,261 1,757,538 1,214,180 1,009,118

Increase/(Decrease in Fund Balance) $ (885,540) $ (612,577) $ (253,744) $ (421,576) $ (81,801)

DEBT SERVICE FUND

BEGINNING RESOURCES $ 953,415 $ 953,415 $ 953,415 $ 953,415 $ 953,415

REVENUES

Current Property Taxes $ 3,330,595 $ 3,334,045 $ 3,337,990 $ 3,346,430 $ 3,338,030

Other Revenue 62,015 62,000 62,000 57,000 57,000

TOTAL REVENUES $ 3,392,610 $ 3,396,045 $ 3,399,990 $ 3,403,430 $ 3,395,030

EXPENDITURES

Principal Payments - Bonds $ 2,495,000 $ 2,555,000 $ 2,250,000 $ 2,310,000 $ 2,360,000

Interest Payments - Bonds 886,610 830,045 767,990 710,430 651,030

Capacity for new debt - - 370,000 370,000 370,000

Other Expenses 11,000 11,000 12,000 13,000 14,000

TOTAL EXPENDITURES $ 3,392,610 $ 3,396,045 $ 3,399,990 $ 3,403,430 $ 3,395,030

ENDING RESOURCES $ 953,415 $ 953,415 $ 953,415 $ 953,415 $ 953,415

Increase/(Decrease in Fund Balance) $ - $ - $ - $ - $ -

The long range financial forecast is a planning tool only. It provides a multi-year overview of possible financial conditions. During the annual

budget process, the City Manager and City Council will assess the current needs of the City and make decisions accordingly.

The annual budget is developed within the context of the Comprehensive Master Plan, the Capital Improvement Plan, and the Department

Five Year Plans. Each year these plans are revised based on more current cost estimates, funding constraints, and changing priorities.

The above five year forecast shows the General Fund and Debt Service Funds balanced with planned drawdowns of fund balance for one

time capital purchases. The Debt Service Fund shows additional capacity of $370,000 beginning in FY20/21. The additional capacity is the

amount that will keep debt service expense the same as the current levels. It is estimated that an additional $5 million debt could be issued

and debt service would remain the same. The five year plan does not include a possible bond election, which is currently being considered.

The tax rate changes required to meet the future needs are a decrease of 2.49 cents in FY19/20, a decrease of 1.21 cents in FY20/21, a

decrease of 1.68 cents in FY21/22, and a decrease of 0.02 cents in FY22/23. Please see the following page for the underlying

assumptions of the financial forecast.

244