Page 62 - Cover 3.psd

P. 62

BUDGET OVERVIEW

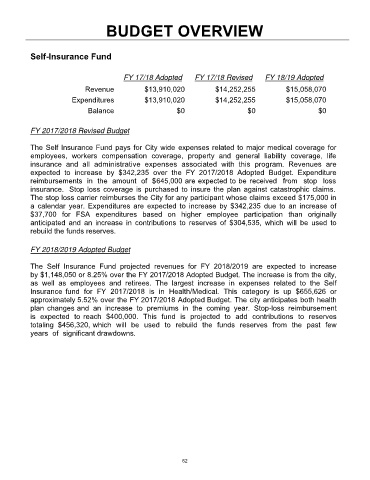

Self-Insurance Fund

FY 17/18 Adopted FY 17/18 Revised FY 18/19 Adopted

Revenue $13,910,020 $14,252,255 $15,058,070

Expenditures $13,910,020 $14,252,255 $15,058,070

Balance $0 $0 $0

FY 2017/2018 Revised Budget

The Self Insurance Fund pays for City wide expenses related to major medical coverage for

employees, workers compensation coverage, property and general liability coverage, life

insurance and all administrative expenses associated with this program. Revenues are

expected to increase by $342,235 over the FY 2017/2018 Adopted Budget. Expenditure

reimbursements in the amount of $645,000 are expected to be received from stop loss

insurance. Stop loss coverage is purchased to insure the plan against catastrophic claims.

The stop loss carrier reimburses the City for any participant whose claims exceed $175,000 in

a calendar year. Expenditures are expected to increase by $342,235 due to an increase of

$37,700 for FSA expenditures based on higher employee participation than originally

anticipated and an increase in contributions to reserves of $304,535, which will be used to

rebuild the funds reserves.

FY 2018/2019 Adopted Budget

The Self Insurance Fund projected revenues for FY 2018/2019 are expected to increase

by $1,148,050 or 8.25% over the FY 2017/2018 Adopted Budget. The increase is from the city,

as well as employees and retirees. The largest increase in expenses related to the Self

Insurance fund for FY 2017/2018 is in Health/Medical. This category is up $655,626 or

approximately 5.52% over the FY 2017/2018 Adopted Budget. The city anticipates both health

plan changes and an increase to premiums in the coming year. Stop-loss reimbursement

is expected to reach $400,000. This fund is projected to add contributions to reserves

totaling $456,320, which will be used to rebuild the funds reserves from the past few

years of significant drawdowns.

62