Page 174 - Cover 3.psd

P. 174

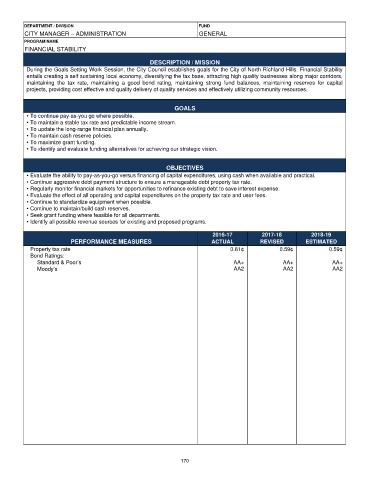

DEPARTMENT / DIVISION FUND

CITY MANAGER – ADMINISTRATION GENERAL

PROGRAM NAME

FINANCIAL STABILITY

DESCRIPTION / MISSION

During the Goals Setting Work Session, the City Council establishes goals for the City of North Richland Hills. Financial Stability

entails creating a self sustaining local economy, diversifying the tax base, attracting high quality businesses along major corridors,

maintaining the tax rate, maintaining a good bond rating, maintaining strong fund balances, maintaining reserves for capital

projects, providing cost effective and quality delivery of quality services and effectively utilizing community resources.

GOALS

• To continue pay-as-you go where possible.

• To maintain a stable tax rate and predictable income stream.

• To update the long-range financial plan annually.

• To maintain cash reserve policies.

• To maximize grant funding.

• To identify and evaluate funding alternatives for achieving our strategic vision.

OBJECTIVES

• Evaluate the ability to pay-as-you-go versus financing of capital expenditures, using cash when available and practical.

• Continue aggressive debt payment structure to ensure a manageable debt property tax rate.

• Regularly monitor financial markets for opportunities to refinance existing debt to save interest expense.

• Evaluate the effect of all operating and capital expenditures on the property tax rate and user fees.

• Continue to standardize equipment when possible.

• Continue to maintain/build cash reserves.

• Seek grant funding where feasible for all departments.

• Identify all possible revenue sources for existing and proposed programs.

2016-17 2017-18 2018-19

PERFORMANCE MEASURES ACTUAL REVISED ESTIMATED

Property tax rate 0.61¢ 0.59¢ 0.59¢

Bond Ratings:

Standard & Poor’s AA+ AA+ AA+

Moody’s AA2 AA2 AA2

170