Page 63 - FY 19 Budget Forecast 91218.xlsx

P. 63

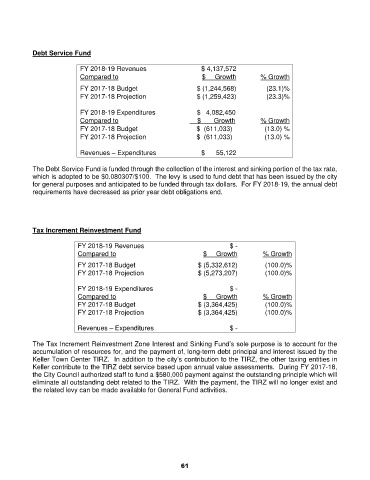

Debt Service Fund

FY 2018-19 Revenues $ 4,137,572

Compared to $ Growth % Growth

FY 2017-18 Budget $ (1,244,568) (23.1)%

FY 2017-18 Projection $ (1,259,423) (23.3)%

FY 2018-19 Expenditures $ 4,082,450

Compared to $ Growth % Growth

FY 2017-18 Budget $ (611,033) (13.0) %

FY 2017-18 Projection $ (611,033) (13.0) %

Revenues – Expenditures $ 55,122

The Debt Service Fund is funded through the collection of the interest and sinking portion of the tax rate,

which is adopted to be $0.080307/$100. The levy is used to fund debt that has been issued by the city

for general purposes and anticipated to be funded through tax dollars. For FY 2018-19, the annual debt

requirements have decreased as prior year debt obligations end.

Tax Increment Reinvestment Fund

FY 2018-19 Revenues $ -

Compared to $ Growth % Growth

FY 2017-18 Budget $ (5,332,612) (100.0)%

FY 2017-18 Projection $ (5,273,207) (100.0)%

FY 2018-19 Expenditures $ -

Compared to $ Growth % Growth

FY 2017-18 Budget $ (3,364,425) (100.0)%

FY 2017-18 Projection $ (3,364,425) (100.0)%

Revenues – Expenditures $ -

The Tax Increment Reinvestment Zone Interest and Sinking Fund’s sole purpose is to account for the

accumulation of resources for, and the payment of, long-term debt principal and interest issued by the

Keller Town Center TIRZ. In addition to the city’s contribution to the TIRZ, the other taxing entities in

Keller contribute to the TIRZ debt service based upon annual value assessments. During FY 2017-18,

the City Council authorized staff to fund a $580,000 payment against the outstanding principle which will

eliminate all outstanding debt related to the TIRZ. With the payment, the TIRZ will no longer exist and

the related levy can be made available for General Fund activities.

61