Page 432 - Hurst FY19 Approved Budget

P. 432

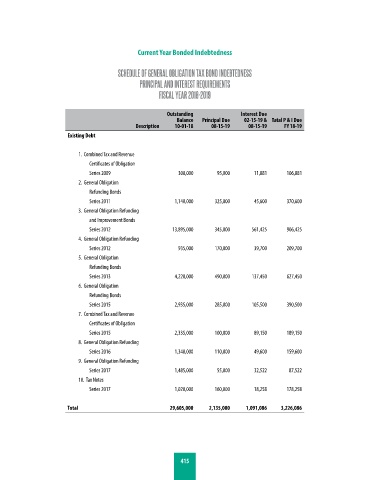

Current Year Bonded Indebtedness

SCHEDULE OF GENERAL OBLIGATION TAX BOND INDEBTEDNESS

PRINCIPAL AND INTEREST REQUIREMENTS

FISCAL YEAR 2018-2019

Outstanding Interest Due

Balance Principal Due 02-15-19 & Tatal P & I Due

Description 10-01-18 08-15-19 08-15-19 FY 18-19

Existing Debt

1. Combined Tax and Revenue

Certificates of Obligation

Series 2009 300,000 95,000 11,881 106,881

2. General Obligation

Refunding Bonds

Series 2011 1,140,000 325,000 45,600 370,600

3. General Obligation Refunding

and Improvement Bonds

Series 2012 13,895,000 345,000 561,425 906,425

4. General Obligation Refunding

Series 2012 935,000 170,000 39,700 209,700

5. General Obligation

Refunding Bonds

Series 2013 4,220,000 490,000 137,450 627,450

6. General Obligation

Refunding Bonds

Series 2015 2,935,000 285,000 105,500 390,500

7. Combined Tax and Revenue

Certificates of Obligation

Series 2015 2,335,000 100,000 89,150 189,150

8. General Obligation Refunding

Series 2016 1,340,000 110,000 49,600 159,600

9. General Obligation Refunding

Series 2017 1,485,000 55,000 32,522 87,522

10. Tax Notes

Series 2017 1,020,000 160,000 18,258 178,258

Total 29,605,000 2,135,000 1,091,086 3,226,086

415