Page 134 - Hurst FY19 Approved Budget

P. 134

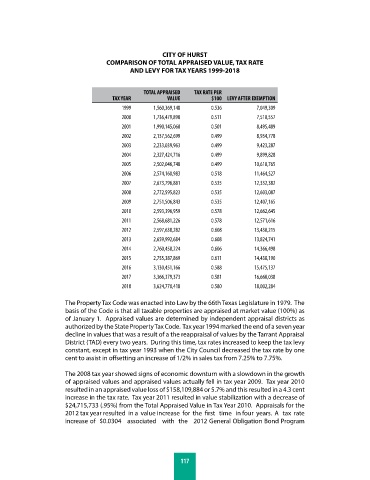

CITY OF HURST

COMPARISON OF TOTAL APPRAISED VALUE, TAX RATE

AND LEVY FOR TAX YEARS 1999-2018

TOTAL APPRAISED TAX RATE PER

TAX YEAR VALUE $100 LEVY AFTER EXEMPTION

1999 1,560,369,148 0.536 7,049,309

2000 1,736,479,898 0.511 7,510,557

2001 1,990,145,060 0.501 8,495,489

2002 2,137,562,699 0.499 8,934,778

2003 2,233,039,963 0.499 9,423,287

2004 2,327,424,716 0.499 9,899,828

2005 2,502,046,748 0.499 10,618,765

2006 2,574,160,983 0.518 11,464,527

2007 2,673,796,881 0.535 12,332,382

2008 2,772,595,823 0.535 12,603,087

2009 2,751,506,843 0.535 12,407,165

2010 2,593,396,959 0.578 12,662,645

2011 2,568,681,226 0.578 12,571,616

2012 2,597,638,282 0.608 13,438,215

2013 2,659,992,684 0.608 13,824,741

2014 2,760,458,224 0.606 14,366,498

2015 2,755,387,869 0.611 14,438,190

2016 3,130,451,166 0.588 15,475,137

2017 3,366,379,373 0.581 16,668,038

2018 3,624,770,418 0.580 18,002,284

The Property Tax Code was enacted into Law by the 66th Texas Legislature in 1979. The

basis of the Code is that all taxable properties are appraised at market value (100%) as

of January 1. Appraised values are determined by independent appraisal districts as

authorized by the State Property Tax Code. Tax year 1994 marked the end of a seven year

decline in values that was a result of a the reappraisal of values by the Tarrant Appraisal

District (TAD) every two years. During this time, tax rates increased to keep the tax levy

constant, except in tax year 1993 when the City Council decreased the tax rate by one

cent to assist in offsetting an increase of 1/2% in sales tax from 7.25% to 7.75%.

The 2008 tax year showed signs of economic downturn with a slowdown in the growth

of appraised values and appraised values actually fell in tax year 2009. Tax year 2010

resulted in an appraised value loss of $158,109,884 or 5.7% and this resulted in a 4.3 cent

increase in the tax rate. Tax year 2011 resulted in value stabilization with a decrease of

$24,715,733 (.95%) from the Total Appraised Value in Tax Year 2010. Appraisals for the

2012 tax year resulted in a value increase for the first time in four years. A tax rate

increase of $0.0304 associated with the 2012 General Obligation Bond Program

117