Page 107 - Grapevine FY19 Operating Budget

P. 107

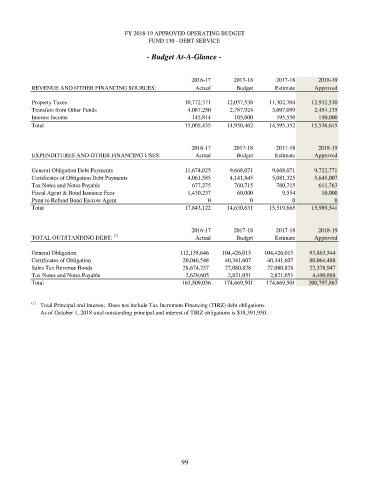

FY 2018-19 APPROVED OPERATING BUDGET

FUND 130 - DEBT SERVICE

- Budget At-A-Glance -

2016-17 2017-18 2017-18 2018-19

REVENUE AND OTHER FINANCING SOURCES: Actual Budget Estimate Approved

Property Taxes 10,772,371 12,057,538 11,302,704 12,932,510

Transfers from Other Funds 4,087,250 2,787,924 3,097,099 2,454,135

Interest Income 145,814 105,000 195,550 150,000

Total 15,005,435 14,950,462 14,595,352 15,536,645

2016-17 2017-18 2017-18 2018-19

EXPENDITURES AND OTHER FINANCING USES: Actual Budget Estimate Approved

General Obligation Debt Payments 11,674,025 9,668,071 9,668,071 9,722,771

Certificates of Obligation Debt Payments 4,061,585 4,141,845 5,081,325 5,645,007

Tax Notes and Notes Payable 677,275 760,715 760,715 611,763

Fiscal Agent & Bond Issuance Fees 1,430,237 60,000 9,554 10,000

Pymt to Refund Bond Escrow Agent 0 0 0 0

Total 17,843,122 14,630,631 15,519,665 15,989,541

2016-17 2017-18 2017-18 2018-19

TOTAL OUTSTANDING DEBT: (1) Actual Budget Estimate Approved

General Obligation 112,158,646 104,426,015 104,426,015 93,863,544

Certificates of Obligation 20,046,548 40,341,607 40,341,607 80,064,488

Sales Tax Revenue Bonds 28,674,237 27,080,828 27,080,828 22,378,947

Tax Notes and Notes Payable 2,629,605 2,821,051 2,821,051 4,490,888

Total 163,509,036 174,669,501 174,669,501 200,797,867

(1) Total Principal and Interest; Does not include Tax Increment Financing (TIRZ) debt obligations.

As of October 1, 2018 total outstanding principal and interest of TIRZ obligations is $18,391,950.

99