Page 234 - Fort Worth City Budget 2019

P. 234

Tax Increment Reinvestment Zone Fund

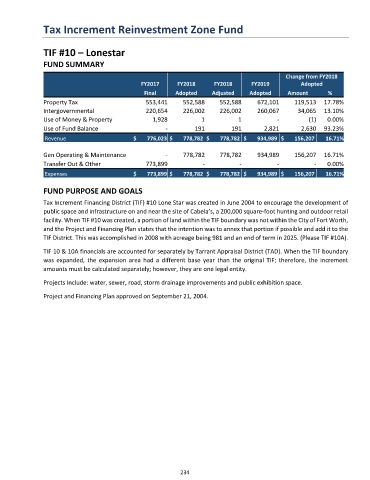

TIF #10 – Lonestar

FUND SUMMARY

Change from FY2018

FY2017 FY2018 FY2018 FY2019 Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 553,441 552,588 552,588 672,101 119,513 17.78%

Intergovernmental 220,654 226,002 226,002 260,067 34,065 13.10%

Use of Money & Property 1,928 1 1 - (1) 0.00%

Use of Fund Balance - 191 191 2,821 2,630 93.23%

Revenue $ 776,023 $ 778,782 $ 778,782 $ 934,989 $ 156,207 16.71%

Gen Operating & Maintenance - 778,782 778,782 934,989 156,207 16.71%

Transfer Out & Other 773,899 - - - - 0.00%

Expenses $ 773,899 $ 778,782 $ 778,782 $ 934,989 $ 156,207 16.71%

FUND PURPOSE AND GOALS

Tax Increment Financing District (TIF) #10 Lone Star was created in June 2004 to encourage the development of

public space and infrastructure on and near the site of Cabela’s, a 200,000 square-foot hunting and outdoor retail

facility. When TIF #10 was created, a portion of land within the TIF boundary was not within the City of Fort Worth,

and the Project and Financing Plan states that the intention was to annex that portion if possible and add it to the

TIF District. This was accomplished in 2008 with acreage being 981 and an end of term in 2025. (Please TIF #10A).

TIF 10 & 10A financials are accounted for separately by Tarrant Appraisal District (TAD). When the TIF boundary

was expanded, the expansion area had a different base year than the original TIF; therefore, the increment

amounts must be calculated separately; however, they are one legal entity.

Projects Include: water, sewer, road, storm drainage improvements and public exhibition space.

Project and Financing Plan approved on September 21, 2004.

234