Page 231 - Fort Worth City Budget 2019

P. 231

Tax Increment Reinvestment Zone Fund

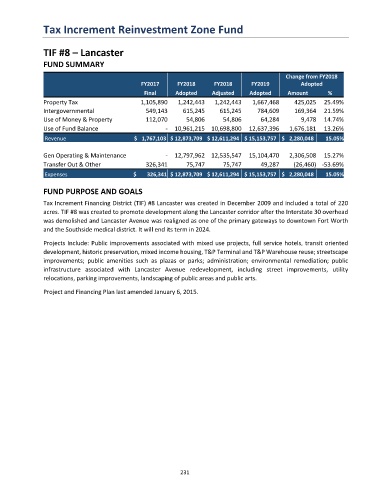

TIF #8 – Lancaster

FUND SUMMARY

Change from FY2018

FY2017 FY2018 FY2018 FY2019 Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 1,105,890 1,242,443 1,242,443 1,667,468 425,025 25.49%

Intergovernmental 549,143 615,245 615,245 784,609 169,364 21.59%

Use of Money & Property 112,070 54,806 54,806 64,284 9,478 14.74%

Use of Fund Balance - 10,961,215 10,698,800 12,637,396 1,676,181 13.26%

Revenue $ 1,767,103 $ 12,873,709 $ 12,611,294 $ 15,153,757 $ 2,280,048 15.05%

Gen Operating & Maintenance - 12,797,962 12,535,547 15,104,470 2,306,508 15.27%

Transfer Out & Other 326,341 75,747 75,747 49,287 (26,460) -53.69%

Expenses $ 326,341 $ 12,873,709 $ 12,611,294 $ 15,153,757 $ 2,280,048 15.05%

FUND PURPOSE AND GOALS

Tax Increment Financing District (TIF) #8 Lancaster was created in December 2009 and included a total of 220

acres. TIF #8 was created to promote development along the Lancaster corridor after the Interstate 30 overhead

was demolished and Lancaster Avenue was realigned as one of the primary gateways to downtown Fort Worth

and the Southside medical district. It will end its term in 2024.

Projects Include: Public improvements associated with mixed use projects, full service hotels, transit oriented

development, historic preservation, mixed income housing, T&P Terminal and T&P Warehouse reuse; streetscape

improvements; public amenities such as plazas or parks; administration; environmental remediation; public

infrastructure associated with Lancaster Avenue redevelopment, including street improvements, utility

relocations, parking improvements, landscaping of public areas and public arts.

Project and Financing Plan last amended January 6, 2015.

231