Page 239 - Fort Worth City Budget 2019

P. 239

Tax Increment Reinvestment Zone Fund

TIF #15 – Stockyards/Northside

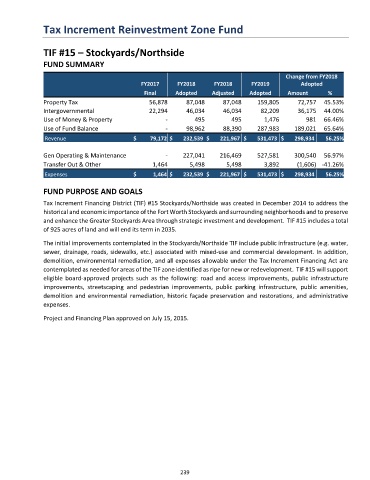

FUND SUMMARY

Change from FY2018

FY2017 FY2018 FY2018 FY2019 Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 56,878 87,048 87,048 159,805 72,757 45.53%

Intergovernmental 22,294 46,034 46,034 82,209 36,175 44.00%

Use of Money & Property - 495 495 1,476 981 66.46%

Use of Fund Balance - 98,962 88,390 287,983 189,021 65.64%

Revenue $ 79,172 $ 232,539 $ 221,967 $ 531,473 $ 298,934 56.25%

Gen Operating & Maintenance - 227,041 216,469 527,581 300,540 56.97%

Transfer Out & Other 1,464 5,498 5,498 3,892 (1,606) -41.26%

Expenses $ 1,464 $ 232,539 $ 221,967 $ 531,473 $ 298,934 56.25%

FUND PURPOSE AND GOALS

Tax Increment Financing District (TIF) #15 Stockyards/Northside was created in December 2014 to address the

historical and economic importance of the Fort Worth Stockyards and surrounding neighborhoods and to preserve

and enhance the Greater Stockyards Area through strategic investment and development. TIF #15 includes a total

of 925 acres of land and will end its term in 2035.

The initial improvements contemplated in the Stockyards/Northside TIF include public infrastructure (e.g. water,

sewer, drainage, roads, sidewalks, etc.) associated with mixed-use and commercial development. In addition,

demolition, environmental remediation, and all expenses allowable under the Tax Increment Financing Act are

contemplated as needed for areas of the TIF zone identified as ripe for new or redevelopment. TIF #15 will support

eligible board-approved projects such as the following: road and access improvements, public infrastructure

improvements, streetscaping and pedestrian improvements, public parking infrastructure, public amenities,

demolition and environmental remediation, historic façade preservation and restorations, and administrative

expenses.

Project and Financing Plan approved on July 15, 2015.

239