Page 272 - Honorable Mayor and Members of the City Council

P. 272

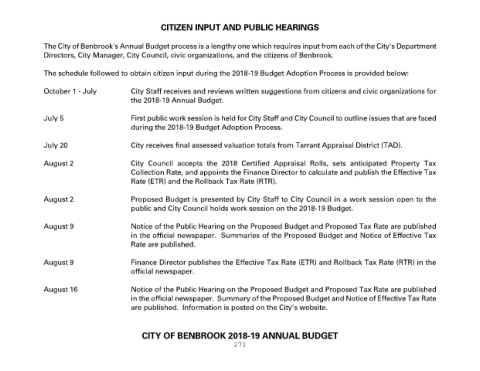

CITIZEN INPUT AND PUBLIC HEARINGS

The City of Benbrook's Annual Budget process is a lengthy one which requires input from each of the City's Department

Directors, City Manager, City Council, civic organizations, and the citizens of Benbrook.

The schedule followed to obtain citizen input during the 2018-19 Budget Adoption Process is provided below:

October 1 - July City Staff receives and reviews written suggestions from citizens and civic organizations for

the 2018-19 Annual Budget.

July 5 First public work session is held for City Staff and City Council to outline issues that are faced

during the 2018-19 Budget Adoption Process.

July 20 City receives final assessed valuation totals from Tarrant Appraisal District (TAD).

August 2 City Council accepts the 2018 Certified Appraisal Rolls, sets anticipated Property Tax

Collection Rate, and appoints the Finance Director to calculate and publish the Effective Tax

Rate (ETR) and the Rollback Tax Rate (RTR).

August 2 Proposed Budget is presented by City Staff to City Council in a work session open to the

public and City Council holds work session on the 2018-19 Budget.

August 9 Notice of the Public Hearing on the Proposed Budget and Proposed Tax Rate are published

in the official newspaper. Summaries of the Proposed Budget and Notice of Effective Tax

Rate are published.

August 9 Finance Director publishes the Effective Tax Rate (ETR) and Rollback Tax Rate (RTR) in the

official newspaper.

August 16 Notice of the Public Hearing on the Proposed Budget and Proposed Tax Rate are published

in the official newspaper. Summary of the Proposed Budget and Notice of Effective Tax Rate

are published. Information is posted on the City’s website.

CITY OF BENBROOK 2018-19 ANNUAL BUDGET

271