Page 317 - FY 19 Budget Forecast 91218.xlsx

P. 317

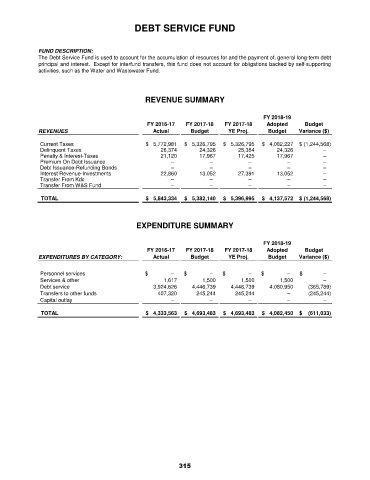

DEBT SERVICE FUND

FUND DESCRIPTION:

The Debt Service Fund is used to account for the accumulation of resources for and the payment of, general long-term debt

principal and interest. Except for interfund transfers, this fund does not account for obligations backed by self-supporting

activities, such as the Water and Wastewater Fund.

REVENUE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Current Taxes $ 5,772,981 $ 5,326,795 $ 5,326,795 $ 4,082,227 $ (1,244,568)

Delinquent Taxes 26,374 24,326 25,384 24,326 –

Penalty & Interest-Taxes 21,120 17,967 17,425 17,967 –

Premium On Debt Issuance – – – – –

Debt Issuance-Refunding Bonds – – – – –

Interest Revenue-Investments 22,860 13,052 27,391 13,052 –

Transfer From Kdc – – – – –

Transfer From W&S Fund – – – – –

TOTAL $ 5,843,334 $ 5,382,140 $ 5,396,995 $ 4,137,572 $ (1,244,568)

EXPENDITURE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Services & other 1,617 1,500 1,500 1,500 –

Debt service 3,924,626 4,446,739 4,446,739 4,080,950 (365,789)

Transfers to other funds 407,320 245,244 245,244 – (245,244)

Capital outlay – – – – –

TOTAL $ 4,333,563 $ 4,693,483 $ 4,693,483 $ 4,082,450 $ (611,033)

315