Page 312 - FY 19 Budget Forecast 91218.xlsx

P. 312

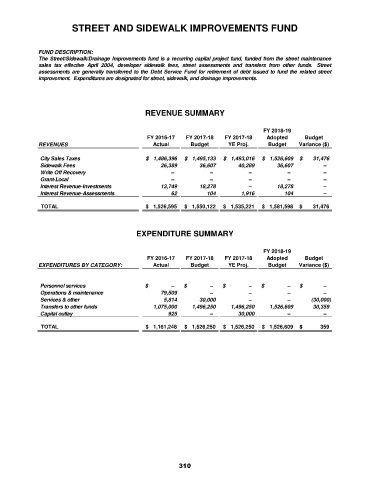

STREET AND SIDEWALK IMPROVEMENTS FUND

FUND DESCRIPTION:

The Street/Sidewalk/Drainage Improvements fund is a recurring capital project fund, funded from the street maintenance

sales tax effective April 2004, developer sidewalk fees, street assessments and transfers from other funds. Street

assessments are generally transferred to the Debt Service Fund for retirement of debt issued to fund the related street

improvement. Expenditures are designated for street, sidewalk, and drainage improvements.

REVENUE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

City Sales Taxes $ 1,486,396 $ 1,495,133 $ 1,493,016 $ 1,526,609 $ 31,476

Sidewalk Fees 26,389 36,607 40,289 36,607 –

Write Off Recovery – – – – –

Grant-Local – – – – –

Interest Revenue-Investments 13,749 18,278 – 18,278 –

Interest Revenue-Assessments 62 104 1,916 104 –

TOTAL $ 1,526,595 $ 1,550,122 $ 1,535,221 $ 1,581,598 $ 31,476

EXPENDITURE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance 79,509 – – – –

Services & other 5,814 30,000 – – (30,000)

Transfers to other funds 1,075,000 1,496,250 1,496,250 1,526,609 30,359

Capital outlay 925 – 30,000 – –

TOTAL $ 1,161,248 $ 1,526,250 $ 1,526,250 $ 1,526,609 $ 359

310