Page 43 - WestworthVillageFY26AdoptedBudget

P. 43

43

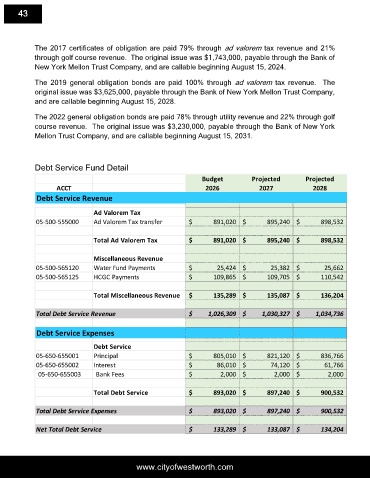

The 2017 certificates of obligation are paid 79% through ad valorem tax revenue and 21%

through golf course revenue. The original issue was $1,743,000, payable through the Bank of

New York Mellon Trust Company, and are callable beginning August 15, 2024.

The 2019 general obligation bonds are paid 100% through ad valorem tax revenue. The

original issue was $3,625,000, payable through the Bank of New York Mellon Trust Company,

and are callable beginning August 15, 2028.

The 2022 general obligation bonds are paid 78% through utility revenue and 22% through golf

course revenue. The original issue was $3,230,000, payable through the Bank of New York

Mellon Trust Company, and are callable beginning August 15, 2031.

Debt Service Fund Detail

Budget Projected Projected

ACCT 2026 2027 2028

Debt Service Revenue

Ad Valorem Tax

05-500-555000 Ad Valorem Tax transfer $ 891,020 $ 895,240 $ 898,532

Total Ad Valorem Tax $ 891,020 $ 895,240 $ 898,532

Miscellaneous Revenue

05-500-565120 Water Fund Payments $ 25,424 $ 25,382 $ 25,662

05-500-565125 HCGC Payments $ 109,865 $ 109,705 $ 110,542

Total Miscellaneous Revenue $ 135,289 $ 135,087 $ 136,204

Total Debt Service Revenue $ 1,026,309 $ 1,030,327 $ 1,034,736

Debt Service Expenses

Debt Service

05-650-655001 Principal $ 805,010 $ 821,120 $ 836,766

05-650-655002 Interest $ 86,010 $ 74,120 $ 61,766

05-650-655003 Bank Fees $ 2,000 $ 2,000 $ 2,000

Total Debt Service $ 893,020 $ 897,240 $ 900,532

Total Debt Service Expenses $ 893,020 $ 897,240 $ 900,532

Net Total Debt Service $ 133,289 $ 133,087 $ 134,204

www.cityofwestworth.com