Page 41 - WestworthVillageFY26AdoptedBudget

P. 41

41

DEBT SERVICE FUND

Debt Service revenue is allocating a portion of the city’s assessed ad valorem tax, along with

transfers from the Water and Hawks Creek Golf Club enterprise funds. The Debt Service fund

makes the annual payment for city-issued debt.

Debt Service expense includes principal and interest payments for city-issued debt. This

includes certificate of obligation and general obligation refunding bonds. In fiscal year 2022,

the city refunded the 2013 certificates of obligation and saved the taxpayers approximately

$30,000 annually. The city continues to contemplate issuing additional debt, as our current

bonded indebtedness matures in future years, to fund drainage infrastructure and street

improvements.

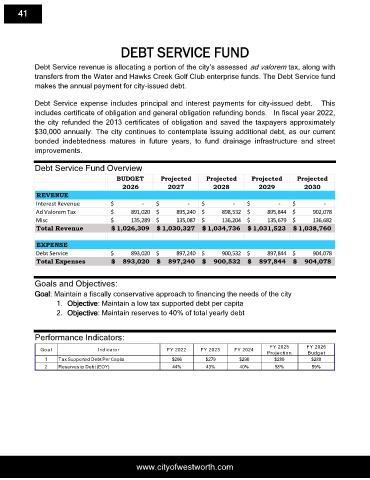

Debt Service Fund Overview

BUDGET Projected Projected Projected Projected

2026 2027 2028 2029 2030

REVENUE

Interest Revenue $ - $ - $ - $ - $ -

Ad Valorem Tax $ 891,020 $ 895,240 $ 898,532 $ 895,844 $ 902,078

Misc $ 135,289 $ 135,087 $ 136,204 $ 135,679 $ 136,682

Total Revenue $ 1,026,309 $ 1,030,327 $ 1,034,736 $ 1,031,523 $ 1,038,760

EXPENSE

Debt Service $ 893,020 $ 897,240 $ 900,532 $ 897,844 $ 904,078

Total Expenses $ 893,020 $ 897,240 $ 900,532 $ 897,844 $ 904,078

Goals and Objectives:

Goal: Maintain a fiscally conservative approach to financing the needs of the city

1. Objective: Maintain a low tax supported debt per capita

2. Objective: Maintain reserves to 40% of total yearly debt

Performance Indicators:

FY 2025 FY 2026

Goal Indicator FY 2022 FY 2023 FY 2024

Projection Budget

1 Tax Supported Debt Per Capita $296 $279 $290 $289 $288

2 Reserves to Debt (EOY) 44% 43% 40% 58% 59%

www.cityofwestworth.com