Page 36 - CITY OF WATAUGA, TEXAS ANNUAL BUDGET PORTRAIT

P. 36

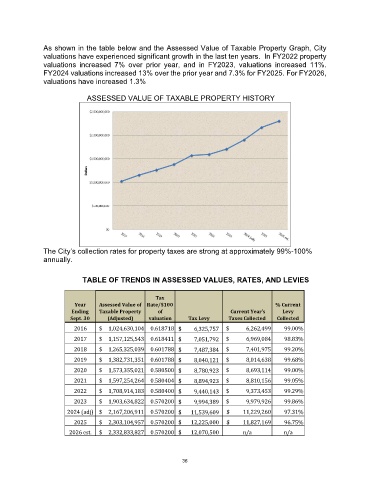

As shown in the table below and the Assessed Value of Taxable Property Graph, City

valuations have experienced significant growth in the last ten years. In FY2022 property

valuations increased 7% over prior year, and in FY2023, valuations increased 11%.

FY2024 valuations increased 13% over the prior year and 7.3% for FY2025. For FY2026,

valuations have increased 1.3%

ASSESSED VALUE OF TAXABLE PROPERTY HISTORY

The City’s collection rates for property taxes are strong at approximately 99%-100%

annually.

TABLE OF TRENDS IN ASSESSED VALUES, RATES, AND LEVIES

Tax

Year Assessed Value of Rate/$100 % Current

Ending Taxable Property of Current Year's Levy

Sept. 30 (Adjusted) valuation Tax Levy Taxes Collected Collected

2016 $ 1,024,630,104 0.618718 $ 6,325,757 $ 6,262,499 99.00%

2017 $ 1,157,125,543 0.618411 $ 7,051,792 $ 6,969,084 98.83%

2018 $ 1,265,325,039 0.601788 $ 7,487,384 $ 7,401,975 99.20%

2019 $ 1,382,731,351 0.601788 $ 8,040,121 $ 8,014,638 99.68%

2020 $ 1,573,355,021 0.580500 $ 8,780,923 $ 8,693,114 99.00%

2021 $ 1,597,254,264 0.580404 $ 8,894,923 $ 8,810,156 99.05%

2022 $ 1,708,914,183 0.580400 $ 9,440,143 $ 9,373,453 99.29%

2023 $ 1,903,634,822 0.570200 $ 9,994,389 $ 9,979,926 99.86%

2024 (adj) $ 2,167,206,911 0.570200 $ 11,539,609 $ 11,229,260 97.31%

2025 $ 2,303,104,957 0.570200 $ 12,225,000 $ 11,827,169 96.75%

2026 est. $ 2,332,833,827 0.570200 $ 12,070,500 n/a n/a

36