Page 308 - CityofSouthlakeFY26AdoptedBudget

P. 308

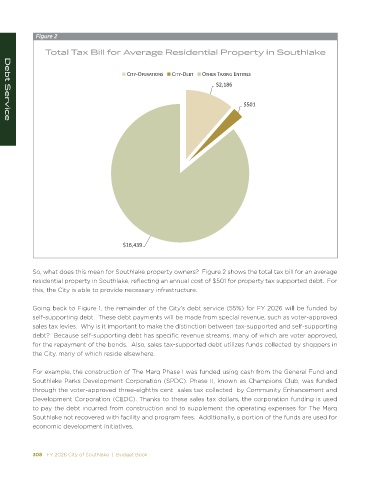

Figure 2

Total Tax Bill for Average Residential Property in Southlake

/dzͲKW Z d/KE^ /dzͲ d Kd, Z d y/E' Ed/d/ ^

ΨϮ͕ϭϴϲ

ΨϱϬϭ

Debt Service

Ψϭϲ͕ϰϯϵ

So, what does this mean for Southlake property owners? Figure 2 shows the total tax bill for an average

residential property in Southlake, reflecting an annual cost of $501 for property tax supported debt. For

this, the City is able to provide necessary infrastructure.

Going back to Figure 1, the remainder of the City’s debt service (55%) for FY 2026 will be funded by

self-supporting debt. These debt payments will be made from special revenue, such as voter-approved

sales tax levies. Why is it important to make the distinction between tax-supported and self-supporting

debt? Because self-supporting debt has specific revenue streams, many of which are voter approved,

for the repayment of the bonds. Also, sales tax-supported debt utilizes funds collected by shoppers in

the City, many of which reside elsewhere.

For example, the construction of The Marq Phase I was funded using cash from the General Fund and

Southlake Parks Development Corporation (SPDC). Phase II, known as Champions Club, was funded

through the voter-approved three-eighths cent sales tax collected by Community Enhancement and

Development Corporation (CEDC). Thanks to these sales tax dollars, the corporation funding is used

to pay the debt incurred from construction and to supplement the operating expenses for The Marq

Southlake not recovered with facility and program fees. Additionally, a portion of the funds are used for

economic development initiatives.

308 FY 2026 City of Southlake | Budget Book FY 2026 City of Southlake | Budget Book 309