Page 129 - CityofSouthlakeFY26AdoptedBudget

P. 129

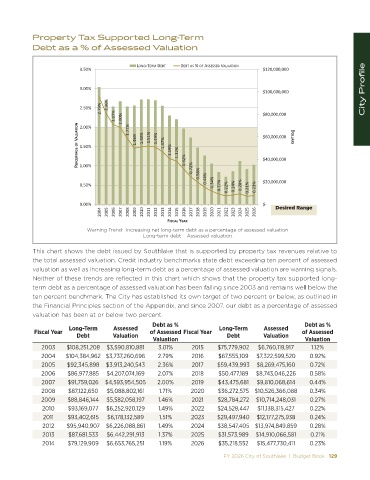

Property Tax Supported Long-Term

Debt as a % of Assessed Valuation

>KE'Ͳd ZD d d ^ й K& ^^ ^^ s >h d/KE

ϯ͘ϱϬй ΨϭϮϬ͕ϬϬϬ͕ϬϬϬ

ϯ͘ϬϬй

ΨϭϬϬ͕ϬϬϬ͕ϬϬϬ City Profile

Ϯ͘ϳϵй

Ϯ͘ϱϬй Ϯ͘ϯϲй

Ϯ͘Ϭϳй Ϯ͘ϬϬй ϭ͘ϳϭй ΨϴϬ͕ϬϬϬ͕ϬϬϬ

W Z Ed ' K& s >h d/KE ϭ͘ϱϬй ϭ͘ϰϲй ϭ͘ϰϵй ϭ͘ϱϭй ϭ͘ϰϵй ϭ͘ϯϳй ϭ͘ϭϵй ϭ͘ϭϮй ΨϲϬ͕ϬϬϬ͕ϬϬϬ K>> Z^

Ϯ͘ϬϬй

ϭ͘ϬϬй

Ϭ͘ϳϮй Ϭ͘ϵϮй Ϭ͘ϱϴй ΨϰϬ͕ϬϬϬ͕ϬϬϬ

Ϭ͘ϱϬй Ϭ͘ϰϰй Ϭ͘ϯϰй Ϭ͘Ϯϳй Ϭ͘ϮϮй Ϭ͘Ϯϰй Ϭ͘Ϯϴй Ϭ͘Ϯϭй Ϭ͘Ϯϯй ΨϮϬ͕ϬϬϬ͕ϬϬϬ

Ϭ͘ϬϬй ΨͲ Desired Range

ϮϬϬϰ ϮϬϬϱ ϮϬϬϲ ϮϬϬϳ ϮϬϬϴ ϮϬϬϵ ϮϬϭϬ ϮϬϭϭ ϮϬϭϮ ϮϬϭϯ ϮϬϭϰ ϮϬϭϱ ϮϬϭϲ ϮϬϭϳ ϮϬϭϴ ϮϬϭϵ ϮϬϮϬ ϮϬϮϭ ϮϬϮϮ ϮϬϮϯ ϮϬϮϰ ϮϬϮϱ ϮϬϮϲ

&/^ > z Z

Warning Trend: Increasing net long-term debt as a percentage of assessed valuation

Long-term debt Assessed valuation

This chart shows the debt issued by Southlake that is supported by property tax revenues relative to

the total assessed valuation. Credit industry benchmarks state debt exceeding ten percent of assessed

valuation as well as increasing long-term debt as a percentage of assessed valuation are warning signals.

Neither of these trends are reflected in this chart which shows that the property tax supported long-

term debt as a percentage of assessed valuation has been falling since 2003 and remains well below the

ten percent benchmark. The City has established its own target of two percent or below, as outlined in

the Financial Principles section of the Appendix, and since 2007, our debt as a percentage of assessed

valuation has been at or below two percent.

Debt as % Debt as %

Long-Term Assessed Long-Term Assessed

Fiscal Year of Assessed Fiscal Year of Assessed

Debt Valuation Debt Valuation

Valuation Valuation

2003 $108,251,208 $3,590,810,881 3.01% 2015 $75,779,902 $6,760,119,917 1.12%

2004 $104,384,962 $3,737,260,696 2.79% 2016 $67,555,109 $7,322,599,520 0.92%

2005 $92,345,898 $3,913,240,543 2.36% 2017 $59,439,993 $8,269,475,160 0.72%

2006 $86,977,885 $4,207,074,169 2.07% 2018 $50,477,189 $8,743,046,226 0.58%

2007 $91,759,026 $4,593,954,505 2.00% 2019 $43,475,681 $9,810,068,614 0.44%

2008 $87,122,650 $5,088,802,161 1.71% 2020 $36,272,575 $10,526,366,088 0.34%

2009 $88,846,144 $5,582,058,197 1.46% 2021 $28,784,272 $10,714,248,031 0.27%

2010 $93,169,077 $6,252,920,129 1.49% 2022 $24,528,447 $11,138,315,427 0.22%

2011 $93,402,615 $6,178,132,589 1.51% 2023 $29,497,940 $12,177,275,938 0.24%

2012 $95,940,907 $6,226,088,861 1.49% 2024 $38,547,405 $13,974,849,859 0.28%

2013 $87,681,533 $6,442,291,913 1.37% 2025 $31,573,989 $14,910,066,581 0.21%

2014 $79,129,909 $6,653,765,251 1.19% 2026 $35,218,552 $15,477,730,411 0.23%

FY 2026 City of Southlake | Budget Book 129