Page 95 - CityofLakeWorthFY26AdoptedBudget

P. 95

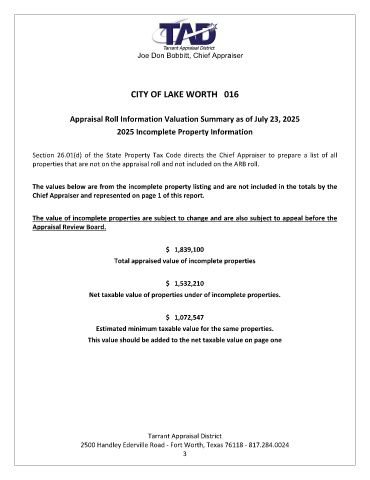

Joe Don Bobbitt, Chief Appraiser

CITY OF LAKE WORTH 016

Appraisal Roll Information Valuation Summary as of July 23, 2025

2025 Incomplete Property Information

Section 26.01(d) of the State Property Tax Code directs the Chief Appraiser to prepare a list of all

properties that are not on the appraisal roll and not included on the ARB roll.

The values below are from the incomplete property listing and are not included in the totals by the

Chief Appraiser and represented on page 1 of this report.

The value of incomplete properties are subject to change and are also subject to appeal before the

Appraisal Review Board.

$ 1,839,100

Total appraised value of incomplete properties

$ 1,532,210

Net taxable value of properties under of incomplete properties.

$ 1,072,547

Estimated minimum taxable value for the same properties.

This value should be added to the net taxable value on page one

Tarrant Appraisal District

2500 Handley Ederville Road - Fort Worth, Texas 76118 - 817.284.0024

3