Page 102 - CityofLakeWorthFY26AdoptedBudget

P. 102

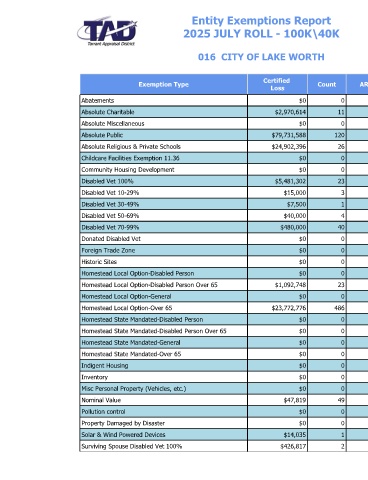

Entity Exemptions Report Page 1 of 3

7/21/2025 2:12:00 PM

2025 JULY ROLL - 100K\40K

016 CITY OF LAKE WORTH

Certified Incomplete Total

Exemption Type Count ARB Loss Count Count Count

Loss Loss Loss

Abatements $0 0 $0 0 $0 0 $0 0

Absolute Charitable $2,970,614 11 $982,278 1 $0 0 $3,952,892 12

Absolute Miscellaneous $0 0 $0 0 $0 0 $0 0

Absolute Public $79,731,588 120 $0 0 $134,580 24 $79,866,168 144

Absolute Religious & Private Schools $24,902,396 26 $0 0 $0 0 $24,902,396 26

Childcare Facilities Exemption 11.36 $0 0 $0 0 $0 0 $0 0

Community Housing Development $0 0 $0 0 $0 0 $0 0

Disabled Vet 100% $5,481,302 23 $0 0 $0 0 $5,481,302 23

Disabled Vet 10-29% $15,000 3 $0 0 $0 0 $15,000 3

Disabled Vet 30-49% $7,500 1 $0 0 $0 0 $7,500 1

Disabled Vet 50-69% $40,000 4 $0 0 $0 0 $40,000 4

Disabled Vet 70-99% $480,000 40 $0 0 $0 0 $480,000 40

Donated Disabled Vet $0 0 $0 0 $0 0 $0 0

Foreign Trade Zone $0 0 $0 0 $0 0 $0 0

Historic Sites $0 0 $0 0 $0 0 $0 0

Homestead Local Option-Disabled Person $0 0 $0 0 $0 0 $0 0

Homestead Local Option-Disabled Person Over 65 $1,092,748 23 $0 0 $0 0 $1,092,748 23

Homestead Local Option-General $0 0 $0 0 $0 0 $0 0

Homestead Local Option-Over 65 $23,772,776 486 $300,000 6 $0 0 $24,072,776 492

Homestead State Mandated-Disabled Person $0 0 $0 0 $0 0 $0 0

Homestead State Mandated-Disabled Person Over 65 $0 0 $0 0 $0 0 $0 0

Homestead State Mandated-General $0 0 $0 0 $0 0 $0 0

Homestead State Mandated-Over 65 $0 0 $0 0 $0 0 $0 0

Indigent Housing $0 0 $0 0 $0 0 $0 0

Inventory $0 0 $0 0 $0 0 $0 0

Misc Personal Property (Vehicles, etc.) $0 0 $0 0 $0 0 $0 0

Nominal Value $47,819 49 $1,141 3 $172,310 3,661 $221,270 3,713

Pollution control $0 0 $0 0 $0 0 $0 0

Property Damaged by Disaster $0 0 $0 0 $0 0 $0 0

Solar & Wind Powered Devices $14,035 1 $0 0 $0 0 $14,035 1

Surviving Spouse Disabled Vet 100% $426,817 2 $0 0 $0 0 $426,817 2