Page 43 - BudgetBookCover_FY26_Adopted.pdf

P. 43

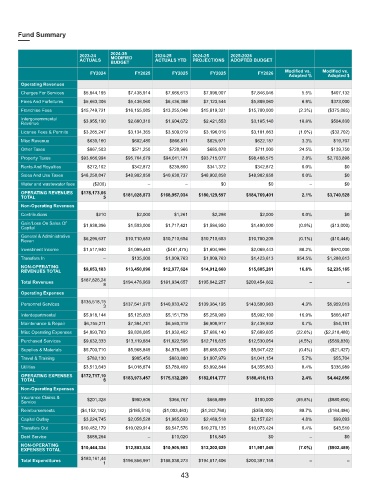

Fund Summary

2024-25

2023-24 MODIFIED 2024-25 2024-25 2025-2026

ACTUALS BUDGET ACTUALS YTD PROJECTIONS ADOPTED BUDGET

Modified vs. Modified vs.

FY2024 FY2025 FY2025 FY2025 FY2026

Adopted % Adopted $

Operating Revenues

Charges For Services $5,844,195 $7,438,914 $7,666,613 $7,098,007 $7,846,046 5.5% $407,132

Fines And Forfeitures $5,663,306 $5,436,060 $6,436,398 $7,123,544 $5,809,060 6.9% $373,000

Franchise Fees $15,749,721 $16,155,085 $13,255,048 $15,819,321 $15,780,000 (2.3%) ($375,085)

Intergovernmental $3,955,190 $2,680,310 $1,604,672 $2,421,553 $3,185,140 18.8% $504,830

Revenue

License Fees & Permits $3,265,247 $3,134,365 $3,509,019 $3,196,016 $3,101,663 (1.0%) ($32,702)

Misc Revenue $630,160 $602,480 $866,611 $825,971 $622,187 3.3% $19,707

Other Taxes $867,503 $571,250 $728,966 $685,878 $711,000 24.5% $139,750

Property Taxes $93,666,994 $95,764,679 $94,011,171 $93,715,077 $98,468,575 2.8% $2,703,896

Rents And Royalties $272,102 $342,872 $239,800 $341,372 $342,872 0.0% $0

Sales And Use Taxes $48,258,847 $48,902,858 $40,638,737 $48,902,858 $48,902,858 0.0% $0

Water and wastewater fees ($200) – – $0 $0 – $0

OPERATING REVENUES $178,173,06 $181,028,873 $168,957,034 $180,129,597 $184,769,401 2.1% $3,740,528

TOTAL 5

Non-Operating Revenues

Contributions $210 $2,000 $1,261 $2,298 $2,000 0.0% $0

Gain/Loss On Sales Of $1,838,396 $1,503,000 $1,717,421 $1,584,950 $1,490,000 (0.9%) ($13,000)

Capital

General & Administrative $6,296,637 $10,710,653 $10,710,654 $10,710,653 $10,700,205 (0.1%) ($10,448)

Reven

Investment Income $1,517,940 $1,099,443 ($461,475) $1,604,996 $2,069,443 88.2% $970,000

Transfers In – $135,000 $1,009,763 $1,009,763 $1,423,613 954.5% $1,288,613

NON-OPERATING

REVENUES TOTAL $9,653,183 $13,450,096 $12,977,624 $14,912,660 $15,685,261 16.6% $2,235,165

Total Revenues $187,826,24 $194,478,969 $181,934,657 $195,042,257 $200,454,662 – –

8

Operating Expenses

$135,518,15

Personnel Services $137,541,970 $140,033,472 $139,364,195 $143,500,983 4.3% $5,959,013

3

Interdepartmental $5,918,144 $5,125,603 $5,151,738 $5,250,989 $5,992,100 16.9% $866,497

Maintenance & Repair $6,755,211 $7,384,741 $6,560,319 $6,908,917 $7,438,932 0.7% $54,191

Misc Operating Expenses $4,893,783 $9,828,085 $1,932,402 $7,686,140 $7,609,605 (22.6%) ($2,218,480)

Purchased Services $9,632,333 $13,119,884 $11,822,596 $12,718,635 $12,530,054 (4.5%) ($589,830)

Supplies & Materials $5,703,710 $5,968,849 $4,978,465 $5,685,078 $5,947,422 (0.4%) ($21,427)

Travel & Training $782,130 $985,450 $863,880 $1,007,979 $1,041,154 5.7% $55,704

Utilities $3,513,643 $4,018,874 $3,789,409 $3,992,844 $4,355,863 8.4% $336,989

OPERATING EXPENSES $172,717,10 $183,973,457 $175,132,280 $182,614,777 $188,416,113 2.4% $4,442,656

TOTAL 6

Non-Operating Expenses

Insurance Claims & $201,328 $980,606 $366,767 $668,899 $100,000 (89.8%) ($880,606)

Service

Reimbursements ($4,152,182) ($185,514) ($1,003,463) ($1,242,768) ($350,000) 88.7% ($164,486)

Capital Outlay $3,224,745 $2,058,528 $1,985,093 $2,489,518 $2,157,621 4.8% $99,093

Transfers Out $10,482,179 $10,029,914 $9,547,576 $10,270,135 $10,073,424 0.4% $43,510

Debt Service $688,264 – $10,020 $16,845 $0 – $0

NON-OPERATING $10,444,334 $12,883,534 $10,905,993 $12,202,629 $11,981,045 (7.0%) ($902,489)

EXPENSES TOTAL

$183,161,44

Total Expenditures 1 $196,856,991 $186,038,273 $194,817,406 $200,397,158 – –

43